7 Financial Mistakes That Are Holding You Back

Financial success often feels like an elusive goal for many people around the world. While earning more money could be one way to improve your financial situation, the truth is that managing what you have is far more critical. Numerous individuals face stagnation in their financial growth not due to lack of income, but because of persistent financial mistakes that limit their progress. Understanding and correcting these errors can open the doors to greater stability, growth, and independence.

In this article, we will uncover seven common financial mistakes that are holding you back. By addressing these issues head-on, you can create a more solid financial foundation and work towards long-term wealth accumulation. Along the way, practical examples and relevant data will highlight the significance of these pitfalls, offering actionable insights for improvement.

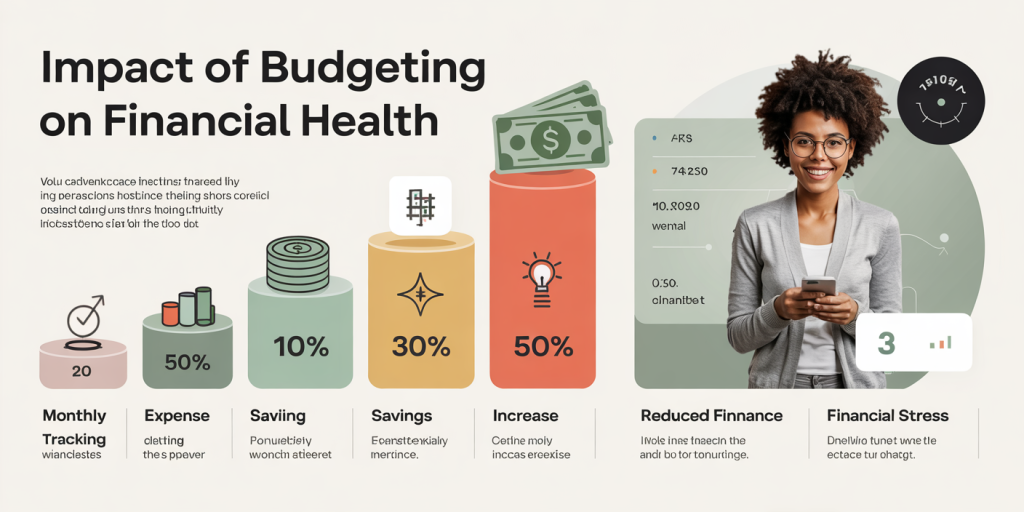

Neglecting to Budget and Track Expenses

One of the most fundamental financial mistakes is the failure to establish and maintain a realistic budget. Budgeting is not just about limiting spending but empowering yourself with control over your money. Not tracking where your funds go monthly often leads to unnoticed leaks in personal finances, resulting in insufficient savings or unanticipated debt.

For instance, John, 35, a marketing manager, believed he was financially responsible but never tracked daily expenses. By setting up a budget using a spreadsheet and tracking app for three months, John discovered he was spending 20% of his monthly income on dining out and subscription services. With this awareness, he reallocated those funds towards paying down his credit card balance.

Anúncios

Statistics show that households that use monthly budgets save on average 15% more annually than those who do not budgeting (Consumer Financial Protection Bureau, 2023). Budgeting is also a powerful tool against impulsive spending, which is another major contributor to financial stagnation.

Anúncios

| Aspect | With Budgeting | Without Budgeting |

|---|---|---|

| Average Annual Savings | $4,500 | $3,900 |

| Financial Stress Level | Low | High |

| Ability to Meet Financial Goals | High | Low |

Tracking expenses is the first step toward eliminating needless expenditure and creating a clear roadmap for your money.

Overreliance on Credit and High-Interest Debt

Many individuals misuse credit cards and personal loans, often falling into high-interest debt traps. Carrying balances month-to-month at interest rates averaging 20% or higher can create a debt spiral that severely limits financial flexibility.

Take the example of Maria, a teacher who rarely paid her credit card in full. Over multiple years, she accumulated $15,000 of credit card debt with an average interest rate of 22%. Due to paying only the minimum monthly amounts, nearly half of her payments went toward interest alone. After seeking credit counseling, Maria devised a debt repayment plan using the debt avalanche method, prioritizing the highest-interest cards first, which saved her approximately $3,000 in interest payments over 18 months.

According to the Federal Reserve, total U.S. consumer credit card debt stood at $930 billion in 2023, an all-time high, reflecting how widespread this problem is. High-interest debt not only drains resources but also adversely affects credit scores and future borrowing options.

Avoiding unnecessary debt and aggressively paying down existing high-interest debt is a critical strategy for financial freedom. Whenever possible, use cash or debit cards for regular purchases and reserve credit cards for emergencies and planned expenses.

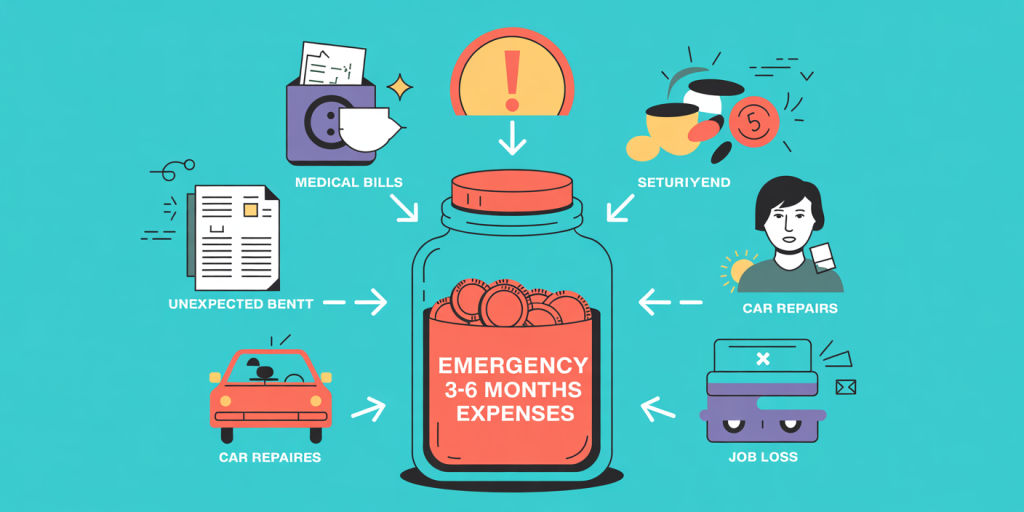

Failing to Build an Emergency Fund

Financial experts consistently emphasize the importance of an emergency fund, yet many people lack even three months’ worth of expenses saved for unforeseen circumstances. Emergencies such as sudden medical bills, car repairs, or temporary job loss can send households into financial crisis without savings to buffer these shocks.

Consider the case of David, a freelance graphic designer who lived paycheck to paycheck. When he suddenly faced a two-month downtime due to surgery, he had no emergency savings and resorted to using high-interest loans, plunging him deep into debt.

Data from the Bureau of Labor Statistics indicates that nearly 40% of U.S. adults would struggle to cover a $400 emergency expense without resorting to credit or borrowing (Federal Reserve, 2022). This lack of financial cushion creates vulnerability to shocks and can derail long-term financial goals.

Experts recommend saving at least three to six months of essential living expenses in a readily accessible account. This fund provides peace of mind and stability, allowing you to navigate unexpected events without derailing your financial progress.

Ignoring Retirement Planning Early

Procrastinating retirement savings is a costly financial mistake compounded by lost compound interest. Many individuals delay contributing to retirement accounts like 401(k)s or IRAs, assuming they can catch up later. Unfortunately, delaying even by a few years significantly reduces the potential growth of investments over time.

For example, Sarah started investing $500 monthly at age 25 versus Mark, who began saving the same amount at age 35. By age 65, Sarah’s account would be worth almost $600,000 compared to Mark’s $350,000, assuming an average return rate of 7%.

| Age Started | Monthly Contribution | Account Value at 65 (7% return) |

|---|---|---|

| 25 | $500 | $600,000 |

| 35 | $500 | $350,000 |

According to a 2023 Fidelity Investments report, the median retirement savings for Americans aged 40-49 was only $88,000, highlighting that many are significantly behind where they need to be. Enrollment in employer-sponsored plans and automatic contributions are effective strategies to kickstart retirement savings, while maximizing employer matching can boost returns.

Starting early provides an undeniable advantage through compound growth and reduces financial stress during retirement.

Overlooking Insurance and Risk Management

Many people view insurance as an unnecessary expense rather than a protective financial tool. Overlooking key insurance policies such as health, life, disability, and property insurance puts your finances at higher risk. Unexpected major expenses can erase savings, force liquidation of investments, or even debt accumulation.

For example, a study by the Insurance Information Institute found that 61% of bankruptcies related to medical bills involved households lacking adequate health insurance. Without proper coverage, costly health emergencies can result in overwhelming debt burdens.

Similarly, failing to carry adequate life or disability insurance leaves families vulnerable to loss of income in the event of untimely death or incapacitation. Risk management through insurance is about safeguarding your financial future and avoiding catastrophic setbacks.

Evaluating coverage needs regularly and shopping for competitive premiums are essential steps for effective risk management and financial protection.

Making Emotional Financial Decisions

Emotions can heavily influence financial behavior, often with adverse outcomes. Emotional spending, panic selling during market downturns, or making impulsive investments often harm long-term wealth building. Recognizing emotional biases is a subtle but important step toward more rational financial management.

A telling example is the 2020 stock market collapse during the early COVID-19 pandemic. Many inexperienced investors sold off their holdings at a loss out of fear instead of holding or buying at lower prices. Those who maintained composure and invested consistently saw substantial recovery gains.

According to a 2021 Dalbar study on investor behavior, the average equity fund investor earned roughly 5% annually over 20 years versus a 9.1% return by the S&P 500 index. This gap is largely due to poor timing and emotional reactions rather than market performance.

To avoid such mistakes, developing a clear financial plan and sticking to it during volatility is critical. Consulting with financial advisors, automating investments, and focusing on long-term goals help reduce emotional interference.

Embracing Financial Technology for Future Stability

The financial landscape is evolving rapidly, driven by technological innovations such as fintech apps, robo-advisors, and blockchain-based services. Those who fail to embrace these advancements risk missing out on enhanced efficiency, lower costs, and better investment performance.

For example, fintech budgeting tools like Mint or YNAB simplify tracking expenses and creating budgets. Robo-advisors such as Betterment or Wealthfront offer automated portfolio management with lower fees than traditional advisors. Additionally, cryptocurrencies and digital assets are increasingly becoming part of diversified portfolios.

While early adoption requires due diligence and an understanding of risks, integrating technology offers future-oriented financial empowerment. Incorporating these tools can enhance decision-making accuracy, optimize returns, and increase financial literacy.

Looking forward, increased digitization, artificial intelligence, and personalized finance platforms will redefine how individuals manage money. Staying informed and adaptable can convert these innovations into opportunities for accelerated financial growth and security.

—

Addressing these seven financial mistakes provides a roadmap to overcoming common barriers in achieving financial wellbeing. From budgeting fundamentals and debt management to early retirement planning and leveraging technology, proactively managing your finances paves the way to a more prosperous future. By learning from real cases and informed strategies, you can avoid costly missteps and unlock your full financial potential.