The Importance of an Emergency Fund and How to Build One Quickly

In today’s unpredictable economic landscape, having an emergency fund is no longer a luxury but a necessity. Whether it’s a sudden job loss, unexpected medical bills, or urgent home repairs, financial emergencies can strike anyone at any time. An emergency fund acts as a financial safety net, providing peace of mind and ensuring that unexpected events don’t spiral into long-term financial hardship. Yet, many people postpone building this crucial cushion, sometimes waiting until a crisis hits to take action.

According to a 2023 report by the Federal Reserve, approximately 25% of American adults lack sufficient savings to cover a $400 emergency expense. This statistic underscores the vulnerability many households face and highlights the critical need for a well-funded emergency reserve. Cultivating this fund quickly requires a strategic approach combined with discipline. This article delves into the importance of having an emergency fund and offers actionable strategies for building one efficiently.

Why an Emergency Fund is Vital for Financial Stability

An emergency fund serves as an essential buffer against unforeseen financial events. Without it, individuals and families might resort to high-interest debt sources like credit cards or payday loans, deepening financial strain. A well-maintained emergency fund enables people to manage life’s sudden challenges without jeopardizing their long-term financial goals such as retirement savings or homeownership.

Financial security is closely tied to mental well-being. Research from the American Psychological Association (2022) found that money-related stress is a leading factor contributing to anxiety and depression among adults. Having a dedicated emergency reserve mitigates financial stress by improving resilience against unexpected expenses. For example, when Sarah, a 34-year-old teacher, lost her car due to an accident, her emergency fund allowed her to cover repairs without impacting her monthly budget or taking on debt.

Anúncios

How Much Should You Save? Determining Your Emergency Fund Target

Experts typically advise saving three to six months’ worth of essential living expenses in an emergency fund. The exact amount, however, varies depending on individual circumstances such as job stability, monthly expenses, and number of dependents. For instance, freelancers or contract workers might prefer a more significant buffer due to income volatility, whereas dual-income households may opt for a smaller fund.

Anúncios

| Expense Category | Typical Monthly Cost | 3-Month Savings Target | 6-Month Savings Target |

|---|---|---|---|

| Rent/Mortgage | $1,200 | $3,600 | $7,200 |

| Utilities | $300 | $900 | $1,800 |

| Groceries | $400 | $1,200 | $2,400 |

| Transportation | $200 | $600 | $1,200 |

| Health Insurance | $300 | $900 | $1,800 |

| Total Monthly Cost | $2,400 | $7,200 | $14,400 |

This table demonstrates how monthly essential expenses translate into emergency fund goals. Taking the time to calculate your own costs is the first practical step in setting a realistic target. If you have dependents or outstanding debt, you might want to save toward the higher end of the range.

Practical Methods to Build Your Emergency Fund Quickly

Accelerating the growth of your emergency fund requires commitment and smart financial planning. One effective method is treating your emergency savings like a recurring bill. Set up an automatic transfer from your checking account to a dedicated savings account immediately after payday. This “pay yourself first” approach builds wealth sustainably without relying on willpower alone.

Another practical tactic is reducing discretionary spending temporarily. For example, cutting back on takeout meals, entertainment subscriptions, or unnecessary shopping can free up significant resources. Consider the case of Mark, a 28-year-old graphic designer, who redirected his monthly $150 coffee shop budget toward his emergency fund—reaching a $3,600 goal within two years without feeling deprived.

Additionally, look for ways to boost income to supplement savings. Freelancing, part-time work, or selling unused belongings are practical avenues. During the pandemic, many individuals utilized online platforms like Upwork or Etsy to generate extra funds, helping them build emergency reserves even amid economic uncertainty.

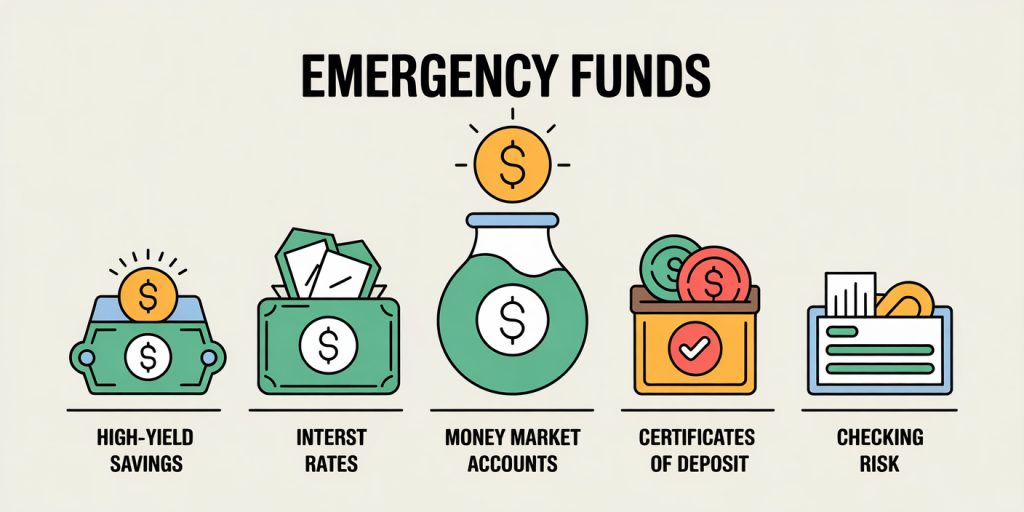

Choosing the Right Account for Your Emergency Fund

Where you keep your emergency fund matters as much as how much you save. Liquidity and safety are paramount. High-yield savings accounts are typically the best option, offering easy access and competitive interest rates compared to traditional savings accounts. Certificates of deposit (CDs) and money market accounts provide higher yields but may limit access or require minimum balances.

| Account Type | Liquidity | Interest Rate Range | Risk Level | Ideal Use Case |

|---|---|---|---|---|

| High-Yield Savings | Immediate withdrawal | 3% – 5% APY | Very low | Everyday emergency fund storage |

| Money Market Account | Usually immediate | 2% – 4% APY | Very low | For higher minimum balance emergency funds |

| Certificates of Deposit | Locked term, penalty for early withdrawal | 3% – 6% APY | Very low | For emergency funds with a defined time horizon |

| Checking Account | Immediate | 0% – 1% | Very low | Not recommended due to low/no interest |

Opting for a high-yield savings account can grow your fund passively while ensuring funds remain accessible when needed. Avoid investing your emergency fund in stocks or other volatile assets due to the potential for losses during critical times.

Real-Life Examples Illustrating Emergency Fund Impact

Understanding the theoretical importance of an emergency fund becomes more concrete through real-life stories. Consider Emily, a single mother who lost her job unexpectedly. Thanks to a six-month emergency fund she had built over several years, she avoided debt, covered living expenses, and confidently searched for a new role without financial panic. In contrast, her neighbor, who had no savings, was forced to borrow at high interest, worsening financial insecurity.

A study by Bankrate (2023) found that 69% of Americans with an emergency fund felt confident managing unexpected expenses, compared to just 34% without savings. This data reflects the empowering effect of financial preparedness. Building an emergency fund is not solely about money; it ultimately translates into greater life stability and control.

Strategies to Maintain and Grow Your Emergency Fund Over Time

Building an emergency fund is just the first step. Maintaining and potentially growing this fund requires ongoing discipline and periodic evaluation. Life circumstances change—new expenses arise, inflation impacts costs, or job security fluctuates—all necessitating adjustments to your emergency fund.

Review your savings annually to ensure it covers at least three to six months of essential expenses. If your expenses rise due to a new mortgage, child’s education, or healthcare costs, adjust your monthly savings plan accordingly. Automating incremental increases in savings contributions can make this process seamless.

Moreover, resist the temptation to dip into your emergency fund for non-emergencies. Establishing clear criteria for what constitutes an emergency (e.g., job loss, urgent car repair, medical emergency) helps maintain the integrity of your fund. If you do use funds, make replenishment a priority.

Future Perspectives: The Growing Need for Emergency Funds in a Changing Economy

Looking ahead, the significance of emergency funds will only intensify. With rising healthcare costs, inflationary pressures, and increasing job market volatility due to automation and globalization, unexpected financial needs are more common. According to the U.S. Bureau of Labor Statistics, job tenure has been decreasing over recent decades, suggesting less job security for many workers.

Additionally, climate change has increased the frequency and severity of natural disasters, which can cause sudden home repairs or displacement. An emergency fund offers a critical buffer in these situations.

Financial experts now also emphasize incorporating digital tools such as budgeting apps and automated savings platforms to build funds efficiently. The evolution of fintech gives savers unprecedented resources to accelerate emergency fund growth.

Ultimately, cultivating a healthy emergency fund is a pillar of personal financial resilience that cannot be overlooked.