How to Organize Your Finances from Scratch: The Ultimate Beginner’s Guide

Managing personal finances can often seem overwhelming, especially when starting from zero. With mounting debt, fluctuating expenses, and diverse income streams, many find it challenging to create and maintain financial stability. However, getting your finances organized is critical to building wealth, reducing stress, and planning for the future. This guide is designed to walk you through the fundamental steps of organizing your money, drawing on practical examples, real case studies, and data-driven advice.

Organizing your finances means more than just tracking spending; it’s about understanding your financial landscape, setting clear objectives, and taking systematic actions to optimize income and reduce liabilities. According to a 2023 survey from the National Endowment for Financial Education, nearly 60% of Americans feel “anxious” when thinking about their financial management, highlighting the need for accessible and effective guidance. Let’s embark on this journey with a clear roadmap tailored for beginners.

Understanding Your Current Financial Situation

Before making any plans, it is crucial to have a comprehensive understanding of your current financial position. Many people underestimate their expenses or ignore their debts, which can stall progress when trying to organize finances effectively. Gathering this information provides a realistic baseline and helps identify areas that need immediate attention.

Start by listing all sources of income, including salaries, side gigs, or passive earnings. For example, Courtney, a 28-year-old freelance graphic designer, was surprised to realize that her irregular freelance income fluctuated by as much as 40% month over month, making it essential to budget conservatively. Next, document all monthly expenses such as rent, utilities, groceries, transportation, subscriptions, and discretionary spending. Tracking two months of expenses can provide a clearer picture of spending habits.

Anúncios

In addition, account for debts, including credit card balances, student loans, and personal loans. Summarizing these liabilities empowers you to prioritize repayments. Tools like budgeting apps (e.g., Mint or YNAB) can simplify this data collection and visualization process. According to a JPMorgan Chase study, users of budgeting software are 36% more likely to save consistently, underscoring the importance of technology in financial organization.

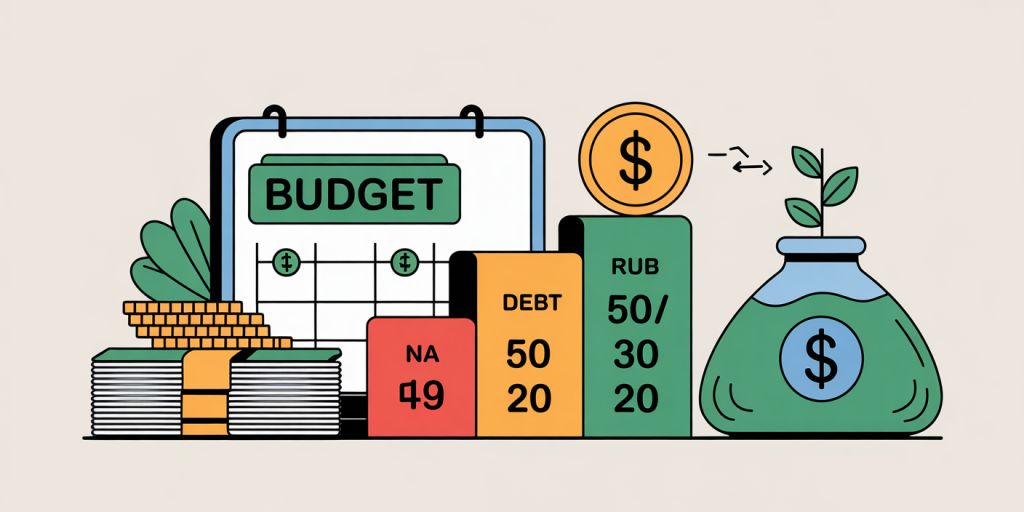

Creating a Realistic Budget and Setting Financial Goals

Once you have a clear understanding of your financial status, the next step is crafting a budget that reflects your actual income and necessities while aligning with your goals. Budgeting is not about strict limitations but rather about giving every dollar a purpose.

Consider the 50/30/20 rule as a starting framework: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. However, this model may need adjustment based on individual circumstances. For example, Raj, a recent college graduate with significant student loans, initially allocated 40% of his income toward debt servicing and adjusted discretionary spending accordingly.

Define concrete financial goals such as building an emergency fund, paying off debt, investing for retirement, or saving for a major purchase. These goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Establishing a timeline increases commitment and clarity. For example, setting a goal to save $5,000 for an emergency fund within 12 months breaks down into manageable monthly targets.

Anúncios

The table below compares typical budget allocations for three common financial goals:

| Financial Goal | Needs (%) | Wants (%) | Savings/Debt Repayment (%) |

|---|---|---|---|

| Emergency Fund Focus | 50 | 20 | 30 |

| Debt Repayment Focus | 45 | 20 | 35 |

| Balanced Growth | 50 | 30 | 20 |

Adjust your budget to reflect your priority and update it regularly as circumstances change.

Organizing Financial Documents and Digital Tools

A well-structured system for managing financial documents is essential for clarity and efficient decision-making. Many beginners overlook this step, resulting in misplaced bills, missed tax deductions, or forgotten debts.

Start by gathering all relevant financial documents: bank statements, loan agreements, tax returns, insurance policies, pay stubs, and receipts. Using labeled physical folders or digital scanning and cloud storage can reduce clutter and ensure accessibility. For example, Vanessa, a small business owner, uses Google Drive folders with subcategories for each financial year and type of document. She credits this organization for expediting her tax filings and avoiding penalties.

Digital tools can also streamline financial management. Apps with secure data encryption such as Personal Capital or Quicken allow users to aggregate multiple accounts, track net worth, and monitor investments in one place. According to a 2022 survey by Deloitte, 47% of millennials prefer managing finances digitally, implying significant advantages in accessibility and real-time tracking.

Create a master spreadsheet or utilize finance dashboards within these apps to log due dates for recurring payments, insurance renewals, and tax deadlines. This proactive approach drastically reduces late fees and missed opportunities for financial optimization.

Building an Emergency Fund and Managing Debt

An essential step in financial stability is creating a safety net through an emergency fund while strategically managing debt. Data from the Federal Reserve in 2023 indicates that about 40% of adults cannot cover a $400 unexpected expense without borrowing, emphasizing the critical nature of emergency savings.

Aim to save at least three to six months’ worth of essential living expenses in a separate, easily accessible savings account. This fund protects you from unplanned events such as medical bills, car repairs, or income loss. For instance, Emily, a single mother, was able to cover two months of lost income through her emergency fund when she unexpectedly lost her job, preventing her from falling into debt.

Simultaneously, develop a debt repayment plan. Two common methods are the debt snowball and debt avalanche approaches. The debt snowball focuses on paying off the smallest debts first to build momentum, while the avalanche targets highest interest rate debt to minimize costs.

| Debt Repayment Method | Strategy | Example Case | Pros | Cons |

|---|---|---|---|---|

| Debt Snowball | Pay smallest balance first | Maria paid off $500 credit card then moved to $300 loan | Builds motivation quickly | May cost more interest over time |

| Debt Avalanche | Pay highest interest rate debt first | Mark focused on a 24% credit card before smaller debt | Saves money on interest | Can be slower to see initial progress |

Select the method that aligns with your personality and financial situation, and automate payments where possible to maintain consistency.

Investing Basics and Planning for the Future

Once your financial foundation is solid, consider engaging in basic investing to grow your wealth and plan for retirement. Investing is no longer exclusive to wealthy individuals, with platforms like Vanguard, Fidelity, and Robinhood democratizing access to the stock market.

Begin with understanding risk tolerance and investment objectives. For beginners, low-cost index funds or exchange-traded funds (ETFs) provide diversification and historically steady returns averaging around 7% annually after inflation (based on S&P 500 performance over the past 50 years). For example, Tyler, a 35-year-old engineer, dedicated 10% of his savings into an S&P 500 index fund, steadily growing his portfolio while minimizing fees and risks associated with individual stocks.

Additionally, explore employer-sponsored retirement plans such as 401(k)s, especially when matching contributions are offered. According to the U.S. Bureau of Labor Statistics, about 73% of private industry workers have access to these plans; failing to contribute enough to capture employer matches is essentially leaving money on the table.

The following table highlights common investment options suitable for beginners:

| Investment Type | Risk Level | Expected Returns | Liquidity | Ideal Use Case |

|---|---|---|---|---|

| Savings Account | Low | 0.5% – 2% | High | Emergency funds, short-term |

| Index Funds / ETFs | Moderate | ~7% (long-term) | High | Retirement, long-term growth |

| Bonds | Low-Moderate | 2% – 5% | Moderate | Income-oriented investments |

| Individual Stocks | High | Variable | High | Aggressive growth |

Invest consistently through dollar-cost averaging and review your portfolio annually or after major life changes.

Future Perspectives: Maintaining and Growing Your Financial Health

Organizing your finances is a dynamic process, not a one-time task. As personal circumstances, economic environments, and financial goals evolve, your financial strategies must adapt accordingly. Developing healthy financial habits such as regular budgeting updates, ongoing education, and proactive adjustments ensure long-term success.

With advancing technology, expect greater integration of AI-powered financial advisors and personalized analytics, which can offer tailored advice and automated goal tracking. For example, robo-advisors currently manage nearly $600 billion assets in the U.S. alone, providing low-cost investment management accessible to beginners.

Moreover, financial literacy continues to rise, supported by platforms like Coursera, Khan Academy, and various podcasts that demystify money management for the average consumer. Cultivating this knowledge equips you to make informed decisions about credit, insurance, taxes, and investment planning.

Lastly, focus on diversifying income streams and protecting wealth from inflation and market volatility. Incorporating side businesses, rental properties, or dividend stocks can increase financial resilience. Regular financial checkups at least twice per year allow you to course-correct and take advantage of new opportunities.

By establishing a strong financial foundation today, you empower yourself to achieve financial freedom, security, and the ability to pursue your aspirations.