Google Sheets Templates That Can Change the Way You Budget

In today’s fast-paced financial world, managing personal or business budgets efficiently is more important than ever. Traditional methods of budgeting—pen and paper or static spreadsheets—often fall short in offering dynamic and customizable solutions. This is where Google Sheets manifests its true potential. With an extensive variety of Google Sheets templates specifically designed for budgeting, users find it easier to track expenses, forecast financial goals, and maintain fiscal discipline. These templates can be a game-changer for individuals and organizations seeking more control and clarity over their finances.

Google Sheets templates provide a streamlined, collaborative platform that users can access anywhere, anytime, with real-time updates. This flexibility ensures you can monitor your budget through your smartphone on the flip side of the world or via your office desktop. Google’s sharing capabilities also allow multiple stakeholders—whether family members, roommates, or department teams—to participate in budget management collectively. The transformative power of these templates resides in their adaptability, ease of use, and the potential for automation which radically enhances how budgets are formulated, tracked, and optimized.

The Power of Pre-Designed Budget Templates in Google Sheets

Not everyone is a budget expert or a spreadsheet guru, which often makes creating a comprehensive budget daunting. However, Google Sheets templates bypass this hurdle by offering ready-to-use formats tailored to various financial needs. These templates come preloaded with formulas, conditional formatting, and charts to visualize spending and saving trends, thus eliminating the need to start from scratch.

For instance, the “Monthly Family Budget” template helps users categorize and monitor household incomes and expenses clearly. It breaks down categories such as groceries, utilities, medical expenses, and entertainment into manageable sections. By using such templates, users can instantly see whether they are overspending in certain categories or staying within their limits. Similarly, freelancers and small businesses can utilize Google Sheets templates like “Freelance Income and Expense Tracker,” which helps manage irregular income streams by juxtaposing them against fixed or variable expenses. This dynamic adaptability makes financial planning less intimidating and more actionable.

Anúncios

A modern workspace scene showing diverse people collaborating remotely on budgeting using Google Sheets templates on laptops and smartphones, with charts and colorful budget categories visible on screen.

According to a 2023 survey by Statista, approximately 62% of consumers who use digital budgeting tools report better financial discipline and reduced unnecessary spending. Google Sheets templates fit squarely within this trend by providing free, customizable budgeting solutions accessible to everyone with a Google account.

How to Select the Right Google Sheets Budget Template for Your Needs

Choosing an appropriate template depends largely on your financial complexity, goals, and the nature of transactions. Basic users might find benefit in simple budgeting templates that just track monthly income and expenditures, while those managing multiple income sources or business cash flow would require more robust templates with advanced features like pivot tables or macro-driven reports.

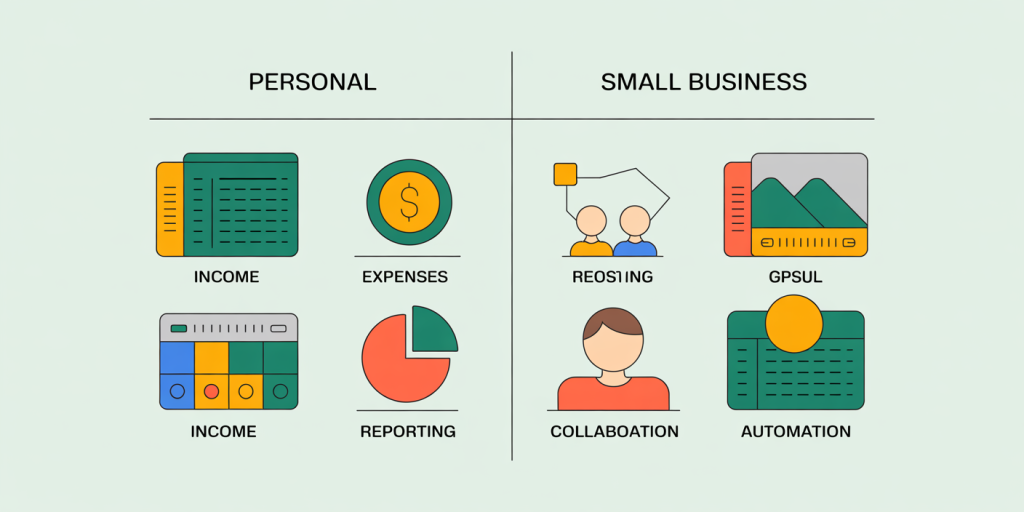

A practical example is comparing the “Personal Budget Planner” template to the “Small Business Financial Tracker.” The former is typically designed for individuals or families planning monthly budgets with predefined categories and expense ceilings. In contrast, the latter includes sections for invoices, tax estimates, profit/loss statements, and cash flow analysis, typically absent in personal budget sheets.

Anúncios

| Feature | Personal Budget Planner | Small Business Financial Tracker |

|---|---|---|

| Income Sources | Single or multiple salary inputs | Multiple clients and diverse income streams |

| Expense Categories | Standard household categories | Operating costs, inventory, payroll |

| Reporting | Monthly summaries, charts | Profit/Loss statements, tax calculations |

| Collaboration | Basic (family/friends) | Enhanced (accountants, finance teams) |

| Automation | Simple formulas for totals and balances | Advanced formulas, macros, and alerts |

Taking a closer look at your requirements can prevent overwhelm and ensure you pick templates that truly enhance, rather than complicate, your budgeting process.

An illustrative comparison table highlighting features of personal versus small business budget templates in Google Sheets, featuring icons for income sources, expense categories, reporting, collaboration, and automation.

Real-Life Impact: Transforming Budgeting Through Google Sheets Templates

One compelling case study comes from a mid-sized startup company that deployed a customized Google Sheets budgeting template to tackle fluctuating cash flows and improve financial transparency across departments. By integrating a shared Google Sheet template, the company’s finance team enabled department heads to input expenses in real-time, categorize costs, and forecast quarterly budgets collaboratively.

Post-adoption, the startup reduced its budget variance by 18% within six months and improved adherence to capital allocation, as reported in their internal review. This collaborative, transparent approach also encouraged ownership among teams, fostering a more accountable financial culture.

Similarly, a 35-year-old freelance graphic designer adopted the “Freelance Budget & Invoice Tracker” template to track payments, due invoices, and monthly expenditures. This template automatically highlighted overdue payments and helped her balance irregular income against monthly bills, resulting in increased savings and the avoidance of late fees.

These real-world examples highlight how Google Sheets templates not only streamline the budgeting process but also promote data-driven decision-making and financial discipline.

Leveraging Automation and Integration for Smarter Budgeting

One of the remarkable advantages of Google Sheets budgeting templates is their ability to integrate with other digital tools and employ automation to reduce manual work and errors. Users can connect Google Sheets with platforms such as Google Forms, Gmail, and third-party apps using Google Apps Script or automation tools like Zapier.

For example, a business owner might automate the import of daily sales data from an online store directly into a budgeting sheet. This automated flow eliminates manual entry errors and provides an up-to-the-minute cash flow status. Similarly, Google Sheets can trigger notifications if expenses exceed a predefined budget threshold, improving proactive budget management.

Moreover, conditional formatting and visual dashboards within templates offer instant visual cues, such as red highlights for overspending in specific categories or green indicators where savings goals are on track. Such features empower users to identify budget inefficiencies quickly and adjust their spending behavior accordingly.

Comparative Analysis: Google Sheets Templates Versus Other Budgeting Tools

When considering budgeting solutions, individuals and organizations often evaluate Google Sheets templates against dedicated budgeting software like Mint, YNAB (You Need A Budget), or Quicken. Each of these options offers distinctive pros and cons in terms of functionality, cost, and flexibility.

| Feature | Google Sheets Templates | Dedicated Budgeting Software (e.g., Mint) |

|---|---|---|

| Cost | Free | Freemium or subscription-based |

| Customizability | Highly customizable | Limited customization, more structured |

| Data Privacy | Controlled by user (data remains private) | Often requires sharing bank login info |

| Accessibility | Cloud-based, supports collaboration | Mobile and desktop apps, some with cloud sync |

| Learning Curve | Moderate, requires spreadsheet familiarity | User-friendly with guided setup |

| Automation & Integration | Extensive (via scripts and third-party apps) | Good, but limited to platform ecosystem |

This comparison shows that Google Sheets templates shine for users who want full control over their budgeting process, have specific tracking needs, or desire collaboration without recurring costs. On the other hand, dedicated software might better suit those seeking automated bank account synchronization, ready-made insights, and minimal setup time.

Future Perspectives: The Evolution of Budgeting with Google Sheets

As emerging technologies continue to reshape finance management, Google Sheets templates are poised to evolve with integration of AI and machine learning capabilities. These advancements could allow templates to offer predictive budgeting, personalized financial advice, and automated anomaly detection, which means users can anticipate and prepare for future expenses more accurately.

Tools like Google’s AI-driven “Explore” feature already assist users by generating insights and suggesting formulas based on user input. Expect this functionality to deepen, potentially enabling templates to analyze spending trends, recommend budget adjustments, and provide timely alerts modeled on historical data.

Furthermore, enhanced integration with cryptocurrency wallets, digital payment platforms, and IoT-based expense tracking devices could transform Google Sheets into a comprehensive financial command center. The continued development of collaborative and cloud-native budgeting templates will likely support increasingly sophisticated financial ecosystems for both personal and organizational use.

A futuristic digital dashboard with AI-powered budgeting features in Google Sheets, including predictive graphs, automated alerts, and integration icons for cryptocurrency wallets and IoT expense trackers.

Mastering your budget is no longer an abstract challenge thanks to user-friendly and feature-rich Google Sheets templates. By leveraging their customization, collaboration, and automation capabilities, individuals and businesses can maintain control over their finances, reduce wasteful spending, and achieve financial goals more effectively. The future promises even smarter budgeting tools within the familiar Google Sheets environment, making financial empowerment accessible to all.