What Are Real Estate Investment Funds (FIIs) and How to Invest Safely

Real Estate Investment Funds (FIIs), known in English as Real Estate Investment Trusts (REITs), have gained significant popularity among investors seeking income and diversification. These funds allow individuals to pool their resources and invest in a diversified portfolio of real estate assets without the complexity and high capital usually associated with direct property ownership. Understanding what FIIs are, how they work, and how to navigate the risks involved is crucial for anyone looking to enter this market safely and effectively.

Understanding Real Estate Investment Funds (FIIs)

Real Estate Investment Funds (FIIs) are collective investment vehicles that gather funds from multiple investors to acquire and manage real estate properties or rights over real estate. These properties might include shopping malls, office buildings, warehouses, residential buildings, or even ventures such as real estate development projects. FIIs offer investors a way to earn income primarily through rental yields and the capital appreciation of properties within the fund.

Anúncios

One distinct advantage of FIIs lies in their liquidity and accessibility. Unlike buying an entire property, where large capital is required and resale often takes months, FIIs typically trade on stock exchanges. For instance, in Brazil, FIIs are traded on the B3 exchange, enabling investors to buy and sell shares in these funds easily. This feature opens real estate investment to a broader range of investors, including those with limited capital.

Anúncios

Types of FIIs and Their Investment Strategies

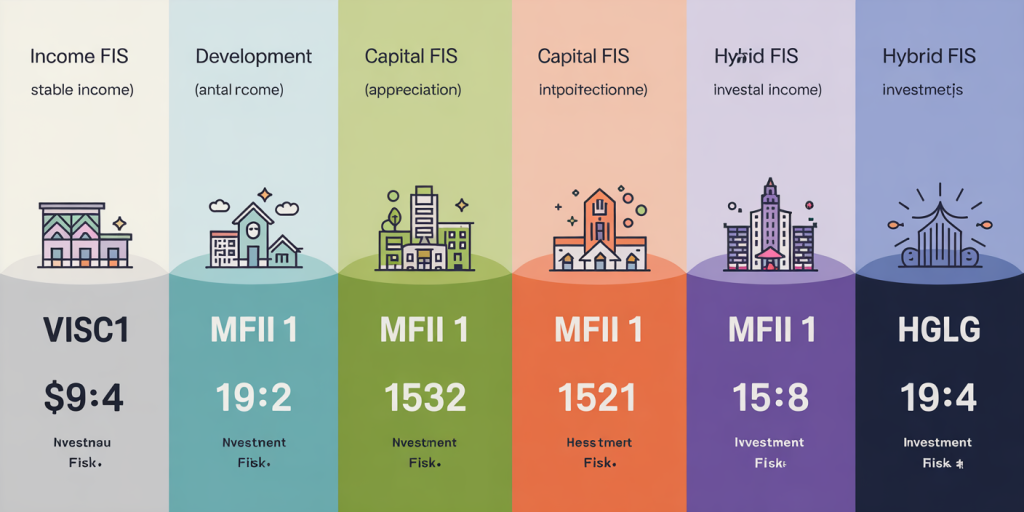

There are different classes of FIIs, each tailored to specific investment goals and risk profiles. Broadly, FIIs fall into categories such as: Income FIIs: These funds invest in income-generating properties like shopping centers or office buildings where the main objective is to receive rental income distributed regularly to investors. Development FIIs: These focus on real estate development projects, looking for capital appreciation when properties are completed and sold or leased. Hybrid FIIs: These combine strategies, holding both income-generating assets and development projects.

For example, the Brazilian FII “VISC11” specializes in shopping malls, leveraging rental income from tenants and capital appreciation due to the increasing value of commercial properties. On the other hand, a fund like “MFII11” invests more aggressively in development projects, offering potentially higher returns but with increased risk.

Comparative Table: Types of FIIs

| FII Type | Main Objective | Risk Level | Typical Investors | Example |

|---|---|---|---|---|

| Income FIIs | Stable rental income | Low to Medium | Conservative | VISC11 |

| Development FIIs | Capital appreciation | Medium to High | Aggressive | MFII11 |

| Hybrid FIIs | Mix of income and growth | Medium | Balanced | HGLG11 |

Understanding the distinctions between these types helps investors align their choices with their financial goals and risk tolerance.

How FIIs Generate Returns

FIIs primarily generate returns through two channels: rental income distributions and capital gains. Rental income forms the bulk of regular, stable returns, as FIIs lease their properties to tenants such as retailers, businesses, or logistics companies. These rental incomes, after deducting operational costs, are usually distributed monthly or quarterly to shareholders according to the number of shares owned.

Capital gains occur when the underlying value of the real estate assets increases. This can be due to improved market conditions, successful property management, or enhancements in the property itself. If the property’s market value grows, the share price of the FII is likely to increase, offering investors gains upon sale.

A real-life example is the Brazilian FII “XPML11”, which invests in warehouses and logistics centers. In 2023, the fund reported a rental yield of approximately 7.5% annually and capital gains of around 4%, resulting in a total return exceeding 11%. This case exemplifies how a well-managed FII in a growing sector (logistics) can provide attractive returns.

Risks Associated with Investing in FIIs

While FIIs provide several advantages, they are not devoid of risks. Investors need to be vigilant and understand the potential downsides before committing capital. The primary risks associated include: Market Risk: Like any asset traded on an exchange, FII shares can fluctuate based on market sentiment, interest rates, or economic conditions. For example, in times of economic recession or rising interest rates, FII share prices can drop. Vacancy Risk: Income-generating FIIs depend heavily on tenants. If properties remain vacant or if tenants default on rent, distributions to investors can fall. Liquidity Risk: Although FIIs are traded on exchanges, certain funds with low trading volumes may face liquidity constraints, making it difficult to sell shares at desired prices. Regulatory Risk: Changes in real estate taxation or investment fund regulations may impact the profitability or legal standing of FIIs.

In 2020, during the height of the COVID-19 pandemic, many retail-focused FIIs saw a sharp decline in rental income as tenants struggled to pay rent or closed their businesses. For instance, FIIs with heavy exposure to shopping malls experienced dividend cuts, reflecting the direct impact of tenant difficulties on income generation.

Steps to Invest in FIIs Safely

Investing in FIIs requires thorough research, strategic planning, and discipline to mitigate associated risks. Here are some practical steps for safe investing in FIIs:

1. Analyze the Fund’s Portfolio

Before investing, scrutinize the types and locations of properties in the FII’s portfolio. Diversified portfolios across sectors (commercial, logistics, residential) and regions tend to reduce risk. For example, MFII11’s focus on development in São Paulo offers different risk exposures compared to VISC11’s commercial properties spread across Brazil’s main cities.

2. Evaluate Fund Management and Transparency

The quality of fund management directly impacts performance. Look for funds managed by experienced teams with transparent reporting on financials, occupancy rates, and tenant profiles. Regulatory filings and quarterly reports should be accessible and clear.

3. Assess Dividend Yield and Consistency

Dividend yield percentage is a crucial metric but must be balanced with consistency. Funds promising extraordinarily high yields might carry hidden risks. Review historical dividend payouts and distributions to gauge stability.

4. Study Market Trends and Economic Indicators

Macroeconomic factors like interest rate changes, GDP growth, and real estate market trends influence FII performance. In Brazil, for example, the Central Bank’s decisions on the Selic rate often affect investor appetite for FIIs, with rate hikes typically leading to lower fund valuations.

5. Diversify Your FII Investment Portfolio

As with any investment, diversification reduces overall risk. Allocating capital across multiple FIIs with different strategies and sectors helps cushion shocks from sector-specific downturns.

Example Practical Scenario:

Suppose you are an investor aiming for moderate income and capital appreciation. You might allocate 40% of your FII investment to income-focused funds like VISC11, 30% to logistics funds like XPML11, and 30% to development funds such as MFII11. This balanced portfolio captures diverse segments of the real estate market with varying risk and return profiles.

FIIs vs. Direct Real Estate Investment: Pros and Cons

Investors often debate between investing in FIIs or purchasing real estate directly. Each has distinct advantages and disadvantages:

| Factor | FIIs | Direct Real Estate |

|---|---|---|

| Initial Capital | Low to Medium | High |

| Liquidity | High (traded on exchange) | Low (property sales take time) |

| Management | Professional fund managers handle assets | Owner responsible for management |

| Diversification | Easy to diversify across many assets | Difficult unless large capital available |

| Income Consistency | Generally stable distributions | Rental income varies, maintenance costs apply |

| Transaction Costs | Lower brokerage fees | High taxes, notary, and broker fees |

FIIs provide a more accessible and liquid route for small and medium investors to participate in the real estate market, while direct ownership offers control and potential tax benefits for experienced investors with higher capital.

Future Perspectives of FIIs in the Market

The outlook for FIIs remains robust, driven by increasing urbanization, technological advances in property management, and investor preference for diversified income streams amid uncertain markets. Data from the Brazilian market illustrates an annual growth rate exceeding 10% in FII market capitalization between 2018 and 2023, indicating growing investor confidence.

Emerging sectors such as logistics centers driven by e-commerce expansion offer promising opportunities. For example, U.S.-based REITs focused on data centers and e-commerce logistics reported average annual returns of over 12% in recent years, setting a precedent for similar funds worldwide.

Technological innovations like blockchain and smart contracts also promise to increase transparency, liquidity, and reduce operational costs in FIIs, making them even more attractive in the future.

Furthermore, sustainability trends influence real estate investment decisions. Funds investing in green buildings and energy-efficient properties are gaining favor as regulatory frameworks tighten worldwide. Such sustainability-focused FIIs may offer lower risks related to environmental liabilities and attract premium tenants.

In conclusion, FIIs represent a dynamic and flexible investment option within the real estate sector. With thoughtful strategies, awareness of risks, and attention to market movements, investors can safely harness the benefits of real estate diversification and income generation through FIIs. As the landscape evolves, keeping abreast of innovation and sector trends will be key to maximizing long-term gains.