Investor Profile: Find Out Yours Before You Invest

Understanding your investor profile is a critical step before committing capital to any investment vehicle. In an unpredictable financial world, knowing whether you are a conservative, balanced, or aggressive investor can dramatically affect your portfolio’s performance and your emotional well-being during market fluctuations. This article guides you through defining your investor profile, illustrated by practical examples and data-backed insights, so you can make informed and personalized investment choices.

Understanding the Importance of Investor Profiles

Investor profiles represent the risk tolerance, financial goals, and investment horizon of individuals. They function as a framework to align investment strategies with personal preferences and market conditions. According to a survey by the CFA Institute, 65% of investors who had clear risk profiles were more satisfied with their portfolio outcomes compared to those who did not assess their risk appetites.

Consider two investors: Sarah, a 30-year-old software engineer saving for retirement at 60, and John, a 55-year-old planning for a near-term home purchase in three years. Sarah’s longer time horizon and capacity to absorb losses suggest a more aggressive profile; meanwhile, John’s shorter horizon demands caution. Misjudging profiles can lead to inappropriate investments, such as exposure to volatile stocks when capital preservation is paramount.

Common Types of Investor Profiles

Anúncios

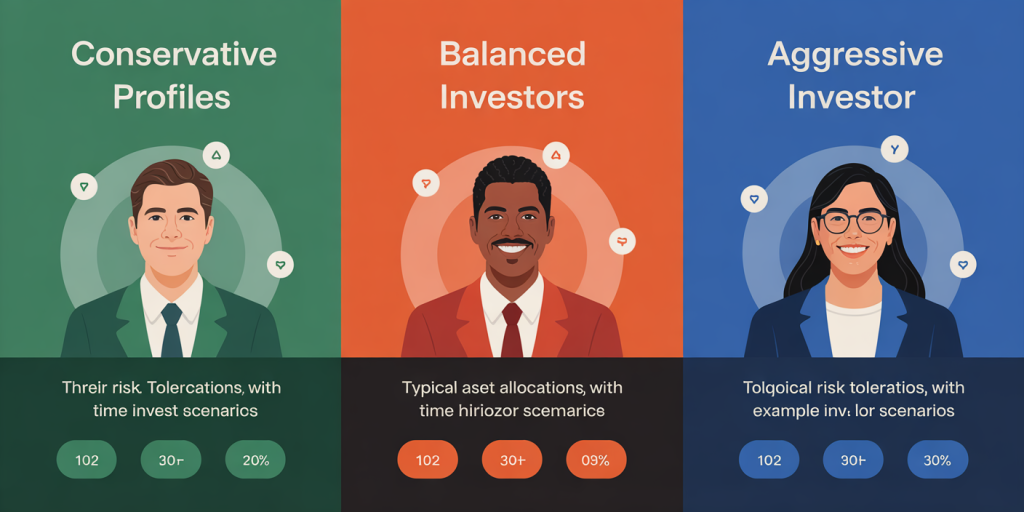

Investor profiles typically fall into three broad categories: conservative, balanced, and aggressive. Each type reflects a different approach to risk and reward, influencing asset allocation, investment choices, and expected returns.

Conservative investors prioritize capital preservation and steady income. They often lean toward bonds, fixed deposits, and blue-chip stocks. For instance, retirees who rely on their investment income prefer low-volatility options, accepting lower returns for reduced risk.

Balanced investors seek a mix of growth and safety. They diversify portfolios between equities and fixed income, enabling potential capital appreciation while cushioning against market downturns. A mid-career professional with moderate financial responsibilities is an example of this profile.

Aggressive investors pursue maximum long-term growth by accepting significant short-term volatility. Typically, they heavily invest in equities, small-cap stocks, or alternative assets like cryptocurrencies. A young entrepreneur with high income and risk tolerance exemplifies this type.

The following table summarizes the characteristics and typical asset allocations of each profile:

Anúncios

| Investor Profile | Risk Tolerance | Time Horizon | Typical Asset Allocation (Equity:Debt) | Example Scenario |

|---|---|---|---|---|

| Conservative | Low | Short to Medium | 20-40% : 60-80% | Retirees or individuals nearing retirement |

| Balanced | Moderate | Medium to Long | 50-70% : 30-50% | Mid-career professionals |

| Aggressive | High | Long | 80-100% : 0-20% | Young investors, entrepreneurs |

Practical Tools to Discover Your Investor Profile

Several questionnaires and assessment tools help investors determine their profiles objectively. These tools evaluate factors such as age, income, financial obligations, investment goals, reaction to market volatility, and liquidity needs.

For example, Vanguard’s Risk Tolerance Questionnaire gauges comfort with hypothetical market losses and willingness to accept risk for potential gains. A real case demonstrates the effectiveness of such tools: Michael, a 40-year-old marketing manager, initially considered himself aggressive. After completing the questionnaire, he discovered a moderate risk tolerance, which led him to adjust his portfolio from 90% stocks to a more balanced 60%-40% equity-to-bond ratio. This change reduced his portfolio’s volatility while maintaining growth potential.

In addition to structured questionnaires, investors should conduct self-assessment by reflecting on their emotional responses to financial losses or gains. According to DALBAR’s annual study, 75% of retail investors underperform due to poor behavioral choices driven by misaligned risk tolerance.

Aligning Investment Strategies with Your Profile

Understanding your investor profile allows you to tailor your investment strategies for optimal growth and risk balance. For conservative investors, fixed-income securities like government bonds, Treasury Inflation-Protected Securities (TIPS), and dividend-paying stocks become priority choices. For instance, during the 2008 financial crisis, conservative bond holders experienced less than 5% losses, compared to over 50% declines in equity markets.

Balanced investors can diversify across mutual funds, real estate investment trusts (REITs), and blue-chip stocks. The well-known “60/40 portfolio”—60% equities, 40% bonds—is a classic balanced approach historically yielding average annual returns of approximately 7%-8% over 30 years with moderate volatility.

Aggressive investors may focus on high-growth sectors such as technology or emerging markets, allocate funds for high-risk startups, or explore digital assets like Bitcoin and Ethereum. From 2010 to 2020, the NASDAQ Composite delivered an average annual return exceeding 18%, reflecting benefits for aggressive equity investors, although with significant drawdowns during this period.

The table below compares average returns and volatility by investment style over a 10-year span (2012-2022):

| Investment Style | Average Annual Return | Approximate Volatility (Standard Deviation) |

|---|---|---|

| Conservative | 3%-5% | 5%-7% |

| Balanced | 7%-9% | 10%-12% |

| Aggressive | 12%-18% | 18%-25% |

This data emphasizes that while aggressive strategies offer higher returns, they also increase the chance of steep drawdowns.

Real-Life Mistakes and Lessons in Investor Profiling

Misclassification or ignorance of investor profile can result in poor investment outcomes and stress. One notable example includes investors who chased high returns during the dot-com bubble by adopting an overly aggressive stance without adequate risk comprehension. The subsequent crash from 2000-2002 wiped out around 78% of the NASDAQ Composite’s value, severely impacting those unprepared for the volatility.

Conversely, overly conservative investors may miss growth opportunities. The infamous “lost decade” for U.S. stocks between 2000 and 2010 saw sluggish returns, yet equity investors nonetheless had better inflation-beating outcomes than those exclusively in cash or low-yield fixed income.

A practical lesson emerges: investor profiles should evolve with life stages and financial goals. Early-career aggressive profiles may gradually shift toward balanced or conservative as retirement approaches. This dynamic approach ensures portfolios remain aligned with risk capacity and market realities.

Future Perspectives in Investor Profiling

Advancements in technology and artificial intelligence are revolutionizing investor profiling. Robo-advisors utilize algorithms and big data to offer personalized investment advice, adjusting portfolios dynamically as user circumstances or market conditions change. According to a report by Statista, the global robo-advisor assets under management surpassed $1 trillion in 2023, a milestone reflecting rising consumer confidence in automated services.

Furthermore, behavioral finance tools incorporating psychological insights are increasingly incorporated to create holistic investor profiles. These methods are designed to mitigate emotional biases—like panic selling or overconfidence—that traditionally plague retail investors.

Looking ahead, investors may also incorporate Environmental, Social, and Governance (ESG) criteria into their profiles, reflecting a growing preference for sustainable investing. For example, Millennials and Gen Z, who represent a substantial and expanding group of investors, prioritize ethical investments alongside financial returns. A 2022 Morgan Stanley survey reported that 85% of individual investors expressed interest in sustainable portfolios.

The investor profiles of the future will therefore encompass multifaceted dimensions: risk tolerance, financial objectives, behavioral tendencies, and values. This evolution will empower investors to create portfolios that not only meet their economic goals but also align with their principles and expectations of social impact.