How to Build a Realistic and Sustainable Monthly Budget

Creating a monthly budget that is both realistic and sustainable is a foundational step toward financial health. Many individuals struggle to maintain budgets that either overestimate their income or underestimate their expenses, leading to frustration and eventual abandonment of the financial plan. According to a 2023 survey by the National Endowment for Financial Education, nearly 60% of Americans do not have a budget, despite 70% expressing a desire to improve their financial stability. This gap underscores the need for practical and achievable budgeting strategies that can be maintained over time without burnout or neglect.

A realistic monthly budget respects your actual cash flow, prioritizes essential expenses, and allows for personal goals without rigidly restricting everyday choices. Sustainability means the budget can adapt to changes in income, unexpected expenses, and life events. In this article, we explore structured steps to build a monthly budget that can serve as a practical guide for individuals seeking financial control and long-term success.

Understanding Your Financial Landscape

The foundation of any realistic budget starts with understanding your current financial situation. Begin by examining your total income from all sources, including salary, freelance work, interest, dividends, and any side hustles. It is important to use net income (after tax) to get a clear picture that reflects the actual money available for spending.

Next, track your expenses consistently for at least one month. Financial apps like Mint or YNAB can simplify this by categorizing transactions automatically. Pay particular attention to fixed expenses such as rent or mortgage payments, utilities, loan repayments, and insurance. Then record variable expenses like groceries, transportation, entertainment, and dining out, which can fluctuate month to month. Real-life example: Sarah, a graphic designer in Dallas, discovered through tracking that she spent nearly 25% of her monthly income on takeaway coffee and dining, a factor she initially underestimated.

Anúncios

Comprehending where your money flows gives you the baseline to formulate a budget reflective of your reality rather than assumptions or aspirations.

Setting Clear and Achievable Financial Goals

Your budget should be aligned with tangible financial goals, both short-term and long-term. This alignment ensures motivation and prioritization.

Short-term goals may include reducing debt, building an emergency fund, or saving for a vacation. Long-term objectives often involve retirement planning, purchasing a home, or funding education. For example, Mike, a 35-year-old in Seattle, set a goal to pay off $10,000 credit card debt within a year. He allocated an extra $850 per month toward debt payments by reducing discretionary spending, transforming his budget into an effective debt elimination plan.

Anúncios

A SMART (Specific, Measurable, Achievable, Relevant, Time-bound) approach to goal setting creates clarity. Vague goals such as “save more money” lack focus and are difficult to track. Instead, “save $5,000 over 12 months for a home down payment” gives a concrete benchmark and timeframe.

In addition, break down big goals into smaller, manageable monthly targets to avoid feeling overwhelmed and increase the likelihood of sustained budgeting practices.

Allocating Funds: The Zero-Based Budgeting Method

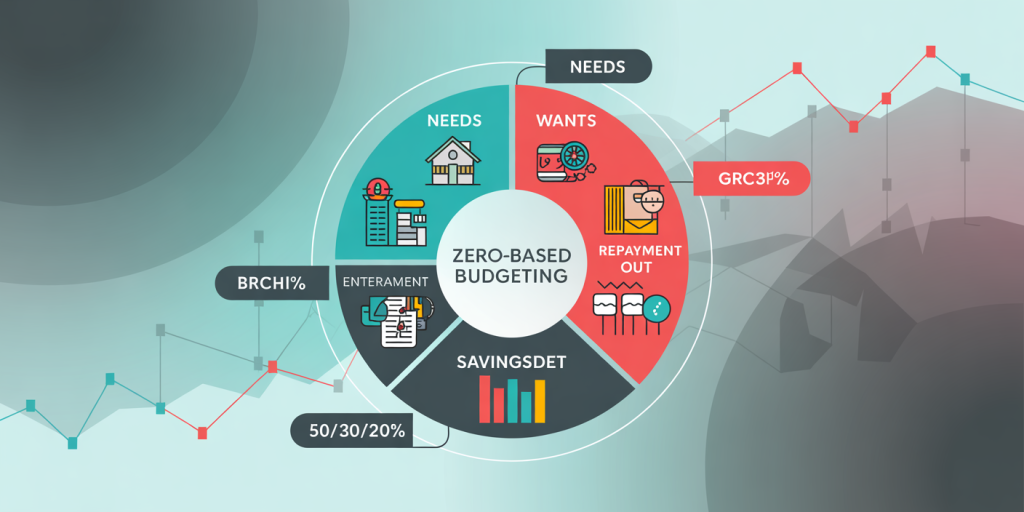

Choosing a budgeting method that best fits your style and financial complexity can improve adherence. One of the most effective strategies is zero-based budgeting (ZBB), where every dollar of your income is assigned a purpose, whether spending, saving, or investing, by the end of the month.

For instance, if your monthly net income is $4,000, ZBB requires that your total expenses, savings, and investments add up exactly to $4,000. This ensures no money is left unassigned, reducing waste or impulsive expenditures.

Here is a comparative table illustrating a typical ZBB allocation percentages vs. the 50/30/20 budgeting rule, a popular alternative:

| Category | Zero-Based Budgeting (Example) | 50/30/20 Rule |

|---|---|---|

| Needs | 55% | 50% |

| Wants | 15% | 30% |

| Savings/Debt | 30% | 20% |

Notice that ZBB requires more active allocation towards savings or debts, reflecting a proactive approach to financial health. If you prefer structure, the 50/30/20 method splits income intuitively: 50% for essentials, 30% for discretionary spending, and 20% toward savings or debt. However, zero-based budgeting demands greater attention but yields clearer accountability.

Practical example: Emma, a freelance writer, used zero-based budgeting to identify that she could increase her emergency fund contribution from 5% to 15% of her income simply by limiting unplanned online shopping.

Controlling Variable Expenses through Tracking and Adjustments

Variable expenses, while flexible, are often the most challenging to control. These include things like dining out, entertainment, clothing, and transportation costs that change monthly.

Effective tracking is a critical step. Using banking apps or expense trackers helps monitor these categories in real time. By reviewing weekly or biweekly spending, you can detect deviations early and adjust accordingly.

For instance, John found that his weekend outings consistently exceeded his allotted entertainment budget. By switching to at-home movie nights or free outdoor activities, he reduced his entertainment expenses by 40%, benefiting his overall budget.

Negotiating recurring expenses such as mobile plans or insurance premiums is another way to cut costs. Many consumers overlook the potential to save by switching providers or consolidating services.

The key is to balance lifestyle satisfaction with financial discipline. If trimming variable expenses feels too restrictive, try a gradual reduction strategy or a “fun money” category that supports guilt-free spending within a controlled limit.

Implementing Emergency Funds and Debt Repayment Plans

Beyond day-to-day expenses, a realistic budget integrates buffers and strategic debt management. Emergency funds act as financial shock absorbers, ideally covering three to six months of essential expenses. According to a Bankrate report in 2024, 25% of Americans have no emergency savings, increasing vulnerability to unplanned events like medical bills or job loss.

Start building an emergency fund by setting aside a small fixed amount each month, such as $100 or 5% of your income. Automate transfers to a high-yield savings account to maintain discipline.

Debt repayment should be incorporated into your budget based on debt amounts and interest rates. Two popular methods include the debt avalanche (paying off highest-interest debts first) and debt snowball (paying off smallest debts first for psychological motivation). Select the strategy that aligns best with your temperament and financial situation.

A comparative table showcases the pros and cons of debt repayment strategies:

| Method | Pros | Cons |

|---|---|---|

| Debt Avalanche | Minimizes interest paid | May take longer before first debt is paid off |

| Debt Snowball | Provides quick wins and improves motivation | Can cost more in accumulated interest |

Case study: Sarah, introduced earlier, applied the debt snowball method and found that paying off her smallest credit card balance within three months gave her the momentum to tackle larger debts with increased confidence.

Future-Proofing Your Budget: Adaptability and Growth

Financial circumstances seldom remain static. Income fluctuations, life changes, inflation, or economic downturns demand that budgets evolve. The best sustainable budgets have flexibility built in.

Plan for periodic reviews every quarter to revisit goals and expense allocations. Adjust your budget categories according to changes such as salary raise, new bills, or shifting priorities.

Technological advancements benefit budget management. Tools with AI-driven insights predict upcoming payments or flag unusual expenses, enabling proactive adjustments.

Furthermore, sustainable budgeting should include investment and growth components beyond saving. Setting aside funds for retirement accounts, education savings plans, or diversified portfolio investments builds long-term wealth.

Adopting a mindset of continuous learning regarding personal finance helps keep your budget relevant. Attending workshops, subscribing to financial magazines, or consulting with advisors ensures your plan reflects best practices.

One real-world example is Jason, who faced income instability due to freelance work in 2023. By creating a flexible budget with a higher emergency fund allocation and cautious expense pacing, he maintained financial equilibrium during lean months.

As financial ecosystems change, a sustainable budget must also incorporate inflation expectation. The Bureau of Labor Statistics reported a 4.5% inflation rate in the US for the previous year, impacting everyday costs. Regularly updating your budget to reflect inflation preserves your purchasing power.