The Role of Inflation in Your Investment Planning

Inflation is one of the most critical economic factors influencing investment planning. It represents the rate at which the general level of prices for goods and services rises, eroding purchasing power over time. For investors, understanding inflation’s impact is paramount, as it directly affects the real returns on investments, cost of living, and long-term financial goals. Ignoring inflation in your investment strategy could mean that your wealth loses value, even if your nominal returns seem favorable.

In recent years, inflation rates have fluctuated significantly across the globe. For example, the U.S. experienced an inflation rate spike from roughly 1.4% in 2020 to over 7% in 2022—the highest in four decades—due to pandemic-related supply chain disruptions and fiscal stimulus measures. This volatile inflation environment has renewed focus on how investors should adjust their portfolios to protect real value. This article explores the intricate role inflation plays in investment planning and offers practical guidance to safeguard and grow your assets amid inflationary pressures.

Understanding Inflation’s Direct Impact on Investments

Inflation directly influences the purchasing power of money. When inflation rises, each dollar buys fewer goods and services, effectively reducing the real value of investment returns. For instance, consider an investor who earns a 6% nominal return, but the inflation rate is 4%. The real return is only about 2%, calculated as nominal return minus inflation. This seemingly small difference can have a profound impact when compounded over long periods.

Historically, periods of high inflation have been challenging for investors holding fixed-income assets such as bonds. For example, during the U.S. stagflation period of the 1970s, inflation rates averaged around 7.1%, severely diminishing the attractiveness of bonds, which offered fixed coupon payments unadjusted for inflation. Consequently, bondholders experienced negative real returns, accelerating a shift toward alternative assets better positioned to hedge inflation risks.

Anúncios

By contrast, equities tend to offer better protection because companies can often increase prices and profits during inflationary times. Nevertheless, not all stocks react the same; for instance, utility companies with regulated pricing often suffer during inflationary spikes, while consumer staples typically maintain steady demand and pricing power.

Inflation and Portfolio Diversification Strategies

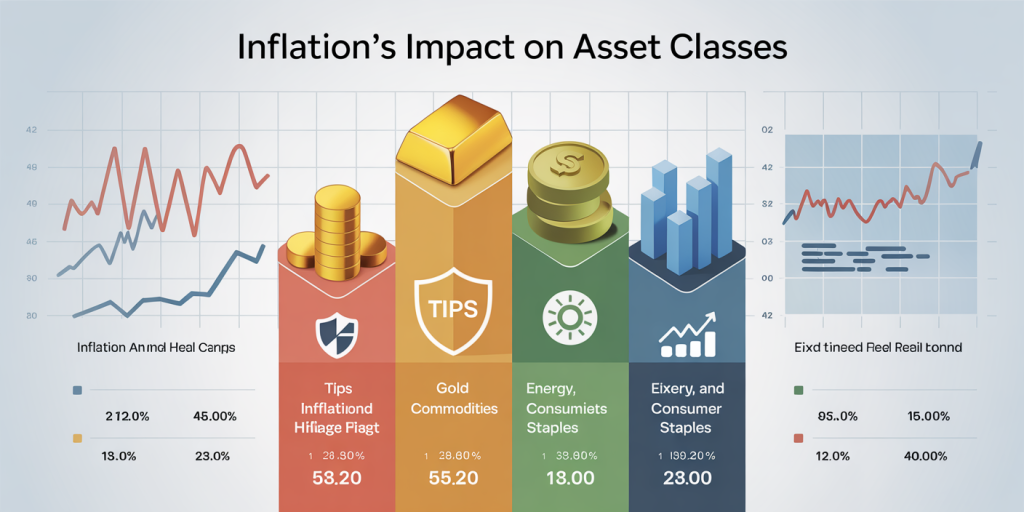

Incorporating inflation expectations into portfolio diversification is essential to preserve real wealth. An effective strategy involves balancing asset classes that perform differently under inflationary pressures.

Treasury Inflation-Protected Securities (TIPS) are government bonds designed specifically to shield investors from inflation. The principal of TIPS adjusts based on changes in the Consumer Price Index (CPI), ensuring that the interest payments grow accordingly. From 2008 to 2023, TIPS have provided a real return close to zero during low inflation periods but become more valuable in inflationary environments, making them ideal hedges in an inflation-focused portfolio.

Commodities like gold, oil, and agricultural products also tend to rise with inflation. For example, between 2000 and 2011, the price of gold increased close to 600%, partially driven by concerns over rising inflation and currency devaluation. Investors frequently allocate 5-10% of their portfolio to commodities or commodity-linked funds to benefit from inflation-driven price increases.

Equities remain a core part of an inflation-sensitive portfolio but should be tilted towards sectors historically resilient to inflation. Energy, materials, and consumer staples companies usually maintain pricing power during inflationary spikes. A comparative analysis of sector performance during inflationary periods, such as 2004–2008 versus 2016–2018, reveals that while overall equity markets may underperform, these sectors typically outperform broad indices.

| Asset Class | Inflation Hedge Ability | Historical Real Return (2000-2023) | Inflation Sensitivity |

|---|---|---|---|

| TIPS | High | 1.1% | Positive |

| Gold & Commodities | High | 3.3% | Positive |

| Equities (Energy/Materials/Sectors) | Moderate to High | 5.8% | Varies by sector |

| Fixed Income (Nominal Bonds) | Low | -1.2% | Negative |

This table illustrates how different asset classes behave under inflationary regimes, highlighting why diversification is vital.

Anúncios

Inflation’s Effect on Retirement Planning

Inflation risk becomes particularly acute as individuals plan for retirement, where a fixed income stream must stretch over many years. Undervaluing inflation’s role can lead to inadequate savings and reduced quality of life during retirement. For example, if a retiree’s nest egg grows at a nominal rate of 5% but inflation averages 3%, the real growth is only around 2%, which may not keep pace with rising healthcare and living expenses.

A practical example is the rising cost of healthcare—medical costs in the U.S. have historically increased at a rate 2 percentage points higher than general inflation. According to the U.S. Bureau of Labor Statistics, the Medical Care Consumer Price Index exhibited a yearly increase of about 4.3% over the past decade, outpacing general CPI growth at approximately 2.5%. This increasing cost can consume an ever-larger share of retirees’ budgets, underscoring the need to plan for higher inflation in specific expense categories.

To counter inflation risk in retirement, financial advisors often suggest incorporating inflation-protected income vehicles like TIPS or annuities with inflation adjustments into retirement income streams. Additionally, maintaining a diversified portfolio with growth assets such as equities and real estate investment trusts (REITs) can help generate returns that outpace inflation.

Inflation and Fixed Income Investments: Navigating Risks and Opportunities

Fixed income investments often take a central place in conservative portfolios due to their steady interest payments. However, inflation poses a significant risk to these instruments—particularly nominal bonds—because inflation erodes the purchasing power of fixed interest payments and principal repayments.

For example, during the U.S. inflation surge in 2021-2022, many nominal bondholders saw real returns turn negative as yields failed to keep up with accelerating price levels. The Bloomberg U.S. Aggregate Bond Index posted a negative total return of -13% in 2022, the worst annual performance since its inception in 1976, emphasizing the vulnerability of conventional bonds in rising inflation environments.

Inflation-indexed bonds remain one of the best defenses; however, investors should also consider short-duration bonds, floating rate notes (FRNs), and bank loans, which typically reset interest rates more frequently and are less sensitive to inflation-induced interest rate hikes. These instruments tend to offer better capital preservation during inflationary periods.

Inflation and Real Estate: A Tangible Hedge

Real estate is often considered a natural hedge against inflation due to its intrinsic value and the ability of landlords to increase rental income with inflation.

Historical data from the National Council of Real Estate Investment Fiduciaries (NCREIF) shows that commercial real estate delivered an average annual return of 9.8% from 1990 to 2020, with a strong correlation to inflation. Furthermore, residential real estate prices in inflationary periods often outpaced or kept pace with CPI growth, offering investors potential real-term capital appreciation.

For instance, during the high-inflation 1970s, real estate investments preserved and grew wealth when many other asset classes faltered. In practice today, investors commonly allocate part of their portfolio to real estate investment trusts (REITs) or direct property ownership to capture rising rents and property values in inflationary cycles.

However, it is essential to consider the impact of rising interest rates—which often accompany inflation surges—on mortgage costs and property valuations. Balancing equity exposure in real estate with an awareness of financing conditions is crucial.

Future Perspectives: Inflation and Investment Planning Ahead

Looking forward, inflation is likely to remain a key consideration for investors due to shifting economic conditions, geopolitical dynamics, and policy responses. Central banks worldwide have adopted a more flexible approach to inflation targeting post-pandemic, raising questions about the potential for sustained higher inflation or even “sticky” inflation.

Technological advancements and globalization, which previously kept inflation muted, face challenges from supply chain disruptions and geopolitical tensions, potentially leading to structural inflationary pressures. For example, the Russia-Ukraine conflict has caused energy and food price spikes, which feed directly into headline inflation figures, influencing investment returns globally.

Investor vigilance is crucial in adapting portfolios to an evolving inflation regime. Emphasizing inflation-protected assets, diversifying across regions with varying inflation impacts, and maintaining a dynamic, flexible investment approach will help investors navigate future inflation uncertainties.

Data analytics and artificial intelligence tools are also becoming invaluable in forecasting inflation trends and optimizing asset allocation in real-time. As inflation dynamics become more complex, leveraging such technologies can give investors a competitive edge.

In summary, inflation plays a pivotal role in shaping investment outcomes over time. Incorporating robust inflation considerations into portfolio construction, asset selection, and retirement planning is essential to protect and grow wealth in both the near and long term. By understanding historical contexts, leveraging inflation-sensitive assets, and anticipating future trends, investors can build resilient strategies that withstand inflation’s challenges and capitalize on its opportunities.