Free Spreadsheets to Organize Your Financial Life

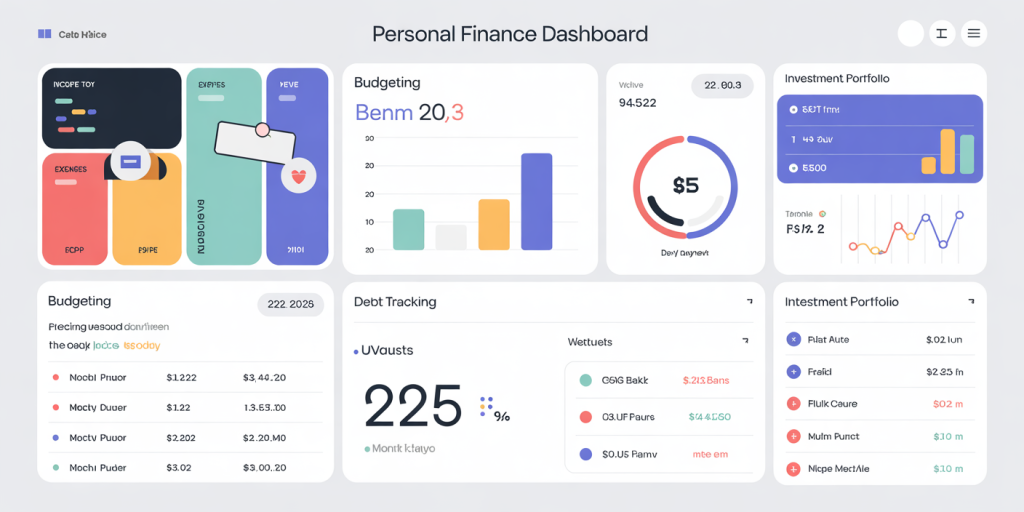

Managing personal finances can be a daunting task for many. With the rise of digital tools, organizing your financial life has become far easier and more efficient. Among these tools, free spreadsheets stand out as accessible, customizable, and powerful solutions for budgeting, tracking expenses, managing debts, and planning for the future. This article explores how free spreadsheets can transform your financial management, offering practical insights, comparisons, and future perspectives on their evolving role.

Why Use Spreadsheets to Manage Finances?

Spreadsheets are a versatile platform widely used for financial planning across households and businesses alike. According to a 2023 survey by the National Endowment for Financial Education, more than 70% of millennials prefer managing their budgets using digital tools—among which spreadsheets remain a favorite due to their flexibility.

One key advantage is customization. Unlike rigid budgeting apps, spreadsheets allow users to tailor categories, formulas, and reports to fit their individual financial situations. A freelance graphic designer, for example, can track variable income streams and business expenses within a single workbook, gaining detailed insights without monthly subscription fees. Furthermore, the intuitive visual layout makes it easier to comprehend complex financial data at a glance.

Anúncios

Anúncios

Popular Free Spreadsheet Templates for Financial Organization

Many reputable organizations and creators offer free spreadsheet templates designed explicitly for personal finance. Templates range from simple monthly budgets to complex investment trackers, debt payoff planners, and net worth calculators.

For instance, Google Sheets provides a “Monthly Budget” template with predefined income, expenses, and savings categories. It enables users to input their income sources, fixed monthly bills, and discretionary spending, automatically calculating surplus or deficit. Meanwhile, Vertex42, a widely recognized template provider, offers a “Debt Reduction Calculator” which uses the avalanche or snowball methods to visualize repayment strategies.

Comparatively, Microsoft Excel’s free downloadable templates like “Personal Financial Statement” provide comprehensive tracking of assets, liabilities, and net worth, ideal for those preparing for financial milestones such as home purchases or retirement.

| Template Name | Provider | Purpose | User Level | Key Features |

|---|---|---|---|---|

| Monthly Budget | Google Sheets | Expense tracking and budgeting | Beginner | Automated surplus calculation |

| Debt Reduction Calculator | Vertex42 | Debt management | Intermediate | Snowball & avalanche methods |

| Personal Financial Statement | Microsoft Excel | Net worth tracking | Advanced | Detailed asset/liability entries |

Setting Up Your Financial Spreadsheet: Best Practices

Creating an effective spreadsheet goes beyond filling in numbers. First, setting realistic categories aligned with your financial goals is crucial. For example, if you are saving for a vacation, adding a “Vacation Fund” category in your savings section promotes accountability and transparency.

It’s also prudent to update your spreadsheet regularly—weekly or biweekly—to reflect real-time changes. This practice not only keeps the data accurate but builds a habit of financial mindfulness. Consider Maria, a college student who uses Google Sheets to track her monthly earnings from part-time jobs against living expenses. Weekly updates helped Maria identify unnecessary spending, such as frequent takeout, enabling her to reallocate funds toward emergency savings.

Automating calculations using spreadsheet functions such as SUM, IF, and VLOOKUP reduces manual errors. For instance, Excel’s IF function can alert users when expenses exceed a preset budget limit, providing instant notifications. Combining these tools ensures your spreadsheet not only organizes data but acts as a dynamic financial assistant.

Practical Applications: How Spreadsheets Address Common Financial Challenges

Managing debt is a widespread concern, with nearly 77% of Americans carrying some form of personal debt, according to a 2023 Experian report. Debt reduction planner spreadsheets provide clear visualizations of how different payment strategies impact total interest paid and payoff timelines. By inputting balances, interest rates, and minimum payments, users can simulate scenarios like prioritizing high-interest credit cards first or leveling payments.

Budgeting remains fundamental yet challenging, especially for households with fluctuating incomes. Freelancers and entrepreneurs benefit from cash flow spreadsheets that categorize variable revenues and periodic expenses distinctly. For example, John, a freelance writer, uses a custom Google Sheets template to monitor project-based income alongside fixed bills. It helps him forecast months with low revenue, adjusting discretionary spending proactively.

Investment tracking is another critical application. Investors managing diversified portfolios use spreadsheets to record buy/sell transactions, dividends, and portfolio performance over time. Free templates with prebuilt formulas calculate metrics such as annualized returns and asset allocation breakdowns, aiding strategic decision-making.

| Financial Challenge | Spreadsheet Solution | Real-Life Application | Impact |

|---|---|---|---|

| High-interest debt | Debt Reduction Calculator | Prioritizing credit cards like Emily reduced interest payments by 25% | Shortens debt payoff period |

| Fluctuating income | Cash Flow Tracker | Freelancer John manages rainy months with better forecasting | Stabilizes monthly finances |

| Investment management | Portfolio Tracker | Retiree Sarah tracks dividends and growth across assets | Enhances portfolio rebalancing |

Benefits Over Paid Financial Software

Though paid financial software offers sophisticated automation, free spreadsheets present compelling advantages for many users. First, the zero-cost factor is significant. With inflation pressures—as reported by the U.S. Bureau of Labor Statistics in 2023 showing 6.5% annual consumer price increase—free tools reduce financial burden on households.

Privacy is another critical consideration. Unlike some paid platforms that sync with banks and require sensitive permissions, spreadsheet users control their data entirely. This autonomy appeals especially to privacy-conscious individuals wary of data breaches.

Moreover, spreadsheet power users benefit from unparalleled flexibility and integration. Platforms like Google Sheets enable real-time collaboration, cloud storage, and add-ons such as Google Finance for live stock prices, which paid apps may lack or restrict behind paywalls.

Nonetheless, free spreadsheets require more hands-on effort and technical proficiency than automated apps. Users must feel comfortable creating formulas or integrating add-ins. However, abundant online tutorials and template libraries lower this learning curve.

Future Perspectives: The Evolution of Spreadsheets in Financial Management

Looking ahead, spreadsheets are poised to evolve with the integration of artificial intelligence, automation, and enhanced user interfaces. Tech experts project that by 2026, AI-powered spreadsheet assistants will proactively analyze spending patterns, suggest personalized budgeting tips, and forecast long-term financial scenarios with high accuracy.

For example, imagine a spreadsheet that alerts you by predicting a quarterly cash shortfall before it happens or automatically categorizes transactions using machine learning models trained on your spending history. This level of sophistication merges spreadsheet flexibility with app-like intelligence, revolutionizing personal finance management.

Further, interoperability with other financial platforms will improve. APIs (application programming interfaces) could enable seamless data transfers from banks and investment brokers into your personalized spreadsheet, ensuring real-time updates without compromising privacy.

The rise of mobile-friendly spreadsheet apps enhances accessibility. Future versions might leverage voice commands and augmented reality to visualize financial data in immersive modes, boosting engagement, especially among younger users.

Finally, community-driven template marketplaces will flourish, highlighting prompt adaptation to emerging financial challenges like cryptocurrency tracking, ESG (Environmental, Social, and Governance) investing, and gig economy income diversification.