How Reinvesting Dividends Can Accelerate Your Financial Freedom

Achieving financial freedom is a goal that many investors aspire to, but the path can sometimes seem slow and uncertain. One powerful strategy that can significantly speed up this journey is reinvesting dividends. By funneling dividend payouts back into purchasing additional shares, investors can harness the power of compounding, leading to exponential growth in wealth over time. This article explores how reinvesting dividends works, its advantages, and real-world examples that illustrate its potential impact.

Understanding Dividend Reinvestment: The Basics

Dividends are a portion of a company’s earnings distributed to shareholders, typically on a quarterly basis. They provide investors with a steady income stream and can be seen as a reward for holding shares. Instead of taking this income as cash, investors have the option to reinvest dividends to buy more shares of the same stock or fund.

Dividend Reinvestment Plans (DRIPs) are often offered by companies and brokers to facilitate automatic reinvestment. This allows investors to purchase fractional shares without incurring transaction fees, ensuring the entire dividend amount is invested. The key benefit here is the compounding effect: as your stock base grows, so does the dividend amount you receive, further fueling portfolio growth.

The Power of Compounding Through Dividend Reinvestment

Anúncios

Reinvesting dividends is recognized as a prime example of compound interest at work. Albert Einstein reportedly called compound interest the “eighth wonder of the world,” highlighting how small gains can grow exponentially over time. When dividends are reinvested, the investor’s total shares increase, generating more future dividends – creating a self-reinforcing cycle.

Consider the example of investing $10,000 in a hypothetical stock yielding a 4% dividend annually. If dividends are taken as cash, the investor receives $400 every year. Reinvesting that $400 allows the investor to purchase more shares, which in turn pay dividends the next year, increasing both the income and the number of shares owned.

According to a study by Hartford Funds, investors who reinvested dividends between 1972 and 2018 saw total returns increase by more than 40% compared to those who did not reinvest. This illustrates how reinvesting dividends can markedly accelerate wealth accumulation, making it a fundamental strategy for those targeting long-term financial independence.

Comparing Dividend Reinvestment to Taking Dividends as Cash

To understand the impact of reinvesting dividends, it is helpful to compare two scenarios: one investor reinvesting dividends and another taking dividends as cash.

Anúncios

| Scenario | Initial Investment | Dividend Yield | Investment Horizon | Total Value after 20 Years | Notes |

|---|---|---|---|---|---|

| Dividends Taken as Cash | $10,000 | 4% | 20 years | $21,911 | Dividends spent, no compounding |

| Dividends Reinvested | $10,000 | 4% | 20 years | $29,778 | Dividends reinvested, compounding |

*Assuming a constant stock price and dividend yield for simplicity.*

The table above demonstrates that reinvesting dividends could lead to roughly 36% more wealth accumulation over 20 years than taking dividends as cash. This gap can widen even more when considering real stock market growth, inflation adjustments, and increased dividend payments over time.

Case Studies: Real World Examples of Dividend Reinvestment

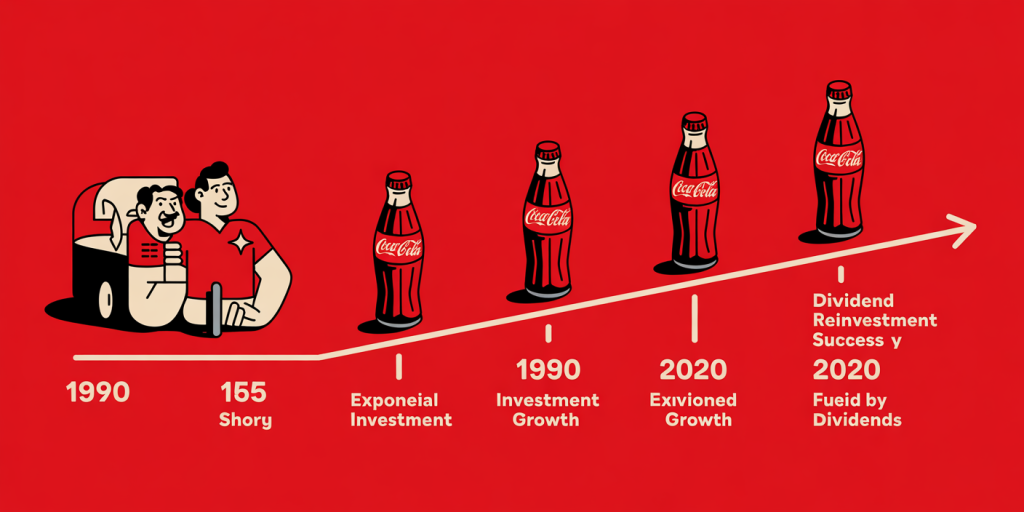

The Coca-Cola Dividend Story

Coca-Cola, a renowned dividend aristocrat, has a long history of steady dividend payments and share price appreciation. An investor who purchased $10,000 worth of Coca-Cola shares in 1990 and consistently reinvested dividends would have seen their investment grow to nearly $305,000 by 2020 (adjusted for splits and dividends), compared to just $70,000 if dividends were taken as cash.

This remarkable growth is attributed primarily to the reinvested dividends compounding over three decades, illustrating the tangible benefits of this strategy. Coca-Cola’s average dividend yield during this period was around 3%, but the reinvestment magnified total returns through both share price growth and dividend compounding.

The Vanguard Dividend Growth Fund Approach

Mutual funds like Vanguard Dividend Growth Fund (VDIGX) also emphasize reinvesting dividends for long-term accumulation. Investors in this fund who reinvested rather than withdrew dividends experienced higher growth and enhanced compounding effects, particularly during periods of market recovery.

Vanguard reports that over a 15-year period ending in 2022, investors who reinvested dividends saw average annual returns approximately 1.5% higher than those who did not. This added return, although seemingly small, accumulates significantly when compounded annually, reinforcing the bottom line that reinvestment substantially accelerates portfolio growth.

Tax Considerations and Strategies for Dividend Reinvestment

While reinvesting dividends offers substantial benefits, it’s important to consider tax implications. In many jurisdictions, dividends are taxable income even if reinvested, which can reduce the net growth achieved through reinvestment strategies.

For example, in the U.S., qualified dividends are typically taxed at capital gains rates, but they still create a taxable event when received. Investors in high tax brackets might face a tax drag effect, where tax payments reduce the amount available for reinvestment. One method to mitigate this is to use tax-advantaged accounts such as IRAs or Roth IRAs, where dividends can be reinvested without immediate tax consequences.

Another approach involves focusing on dividend growth stocks that increase dividend payments over time. These stocks can help counteract inflation and tax effects by progressively increasing income while maintaining reinvestment growth.

A tax-efficient reinvestment strategy might combine: Investing in tax-advantaged accounts when possible Prioritizing qualified dividend stocks for lower tax rates Utilizing dividend reinvestment plans to avoid trading costs and maintain compounding momentum

Practical Tips for Implementing a Dividend Reinvestment Strategy

Successfully accelerating financial freedom through dividend reinvestment requires discipline and a systematic approach. Here are some actionable strategies:

1. Set Up Automatic Reinvestment: Most brokers and dividend-paying companies offer DRIPs that automatically reinvest dividends into fractional shares. This automation prevents the temptation to spend dividends and ensures continuous compounding.

2. Diversify Dividend-Paying Assets: Rather than investing solely in individual stocks, consider diversified dividend-focused ETFs or mutual funds. Diversification reduces risk while maintaining exposure to dividend income and reinvestment growth.

3. Monitor Dividend Sustainability: Not all dividends are safe to reinvest. Companies cutting or suspending dividends can reduce the expected compounding effect. Focus on companies or funds with strong cash flows and consistent dividend history.

4. Be Patient and Long-Term Focused: The most significant benefits of reinvesting dividends manifest over long investment horizons. Investors should view dividend reinvestment as a marathon, not a sprint.

Future Perspectives: The Role of Dividend Reinvestment in Evolving Financial Markets

As global markets evolve with technological innovation and changing economic conditions, dividend reinvestment remains a timeless strategy that aligns well with shifting investor priorities. The rise of robo-advisors and automated investment platforms has made dividend reinvestment more accessible and user-friendly than ever.

In the future, we can anticipate: Increased automation: Platforms will automatically optimize dividend reinvestment based on user goals and tax situations, reducing manual decisions and errors. Customization: AI-driven portfolio management could tailor dividend reinvestment strategies to individual risk tolerance and financial timelines. Global access: As international dividend-paying stocks gain prominence, investors can diversify reinvestment opportunities across multiple economies.

Recent data from Charles Schwab indicates that over the past decade, the utilization of DRIPs has increased by 20%, signifying growing awareness of reinvestment benefits.

In an environment of fluctuating interest rates and market uncertainty, dividend reinvestment provides a reliable method to build passive income streams and steadily progress toward financial independence.