How Side Hustles Can Complicate Your Taxes (and How to Prepare for It)

The rise of the gig economy, alongside increasing financial challenges and the desire for extra income, has made side hustles more common than ever. From freelancing and ridesharing to selling handmade goods online, millions of Americans are supplementing their primary income through various side ventures. According to a 2023 report by Upwork, nearly 43% of the U.S. workforce engages in secondary work, with the side hustle trend projected to increase steadily in the coming years.

However, while side hustles can boost your income, they also add complexity to your tax situation. Unlike traditional employment with withholding taxes and simplified reporting, side businesses require a deeper understanding of tax obligations. Failing to properly manage these complexities can lead to costly audits, penalties, or missed opportunities for deductions. This article explores the main ways side hustles complicate taxes and offers practical strategies to prepare and stay compliant.

The Additional Tax Responsibilities of Side Hustlers

When you earn money through a side hustle, your tax experience changes significantly compared to receiving a paycheck from an employer. For traditional jobs, employers withhold income tax, Social Security, and Medicare taxes directly from your wages. However, income from side hustles is considered self-employment income, which means you are responsible for both tracking and reporting it.

Self-employment tax comprises 15.3% of your earnings, covering Social Security and Medicare, separate from federal and state income taxes. For instance, if someone earns $10,000 from freelancing in addition to a salaried job, they may owe around $1,530 just in self-employment taxes plus federal and state income taxes on that amount. This is often overlooked by side hustlers new to filing self-employment income, leading to underpayment.

Anúncios

Additionally, income from side hustles is reported on IRS Schedule C (Profit or Loss from Business) or Schedule C-EZ, rather than Form W-2. Paperwork requirements increase as you may receive 1099 forms from clients or marketplaces, but sometimes payments under $600 are not reported by third parties, making record-keeping critical. Without diligent tracking of both income and expenses, taxpayers may underreport earnings, which can trigger audits.

Navigating Expenses and Deductible Costs

One advantage of side hustles is the potential to deduct business-related expenses. Unlike wages on a W-2, where your employer deducts taxes and covers business costs, self-employed individuals can deduct ordinary and necessary expenses related to their side work.

For example, a rideshare driver can deduct mileage, tolls, vehicle maintenance, and even a portion of their phone bill. A graphic designer might deduct software subscriptions, home office utilities, and internet costs. However, it requires comprehensive record keeping and understanding which expenses qualify.

A practical case study involves Sarah, a photographer who started a side business during weekends. Over the year, she spent $3,000 on camera equipment and $1,200 on editing software. When tax season arrived, Sarah used a mileage log app to claim her driving expenses related to client shoots, effectively reducing her taxable income and saving hundreds in taxes.

Here is a comparative table illustrating common deductible expenses for popular side hustles:

Anúncios

| Side Hustle Type | Common Deductible Expenses | Examples |

|---|---|---|

| Freelancing | Software, internet, home office, supplies | Adobe subscriptions, Wi-Fi costs |

| Ridesharing | Mileage, tolls, gas, car maintenance | Car repairs, Uber toll fees |

| E-commerce | Inventory, shipping, packaging | Product costs, shipping fees |

| Handmade Goods | Raw materials, market stall fees, equipment | Fabric, craft supplies |

Understanding deductions empowers side hustlers to minimize taxes legally. However, many miss opportunities due to poor record-keeping or uncertainty about expense eligibility.

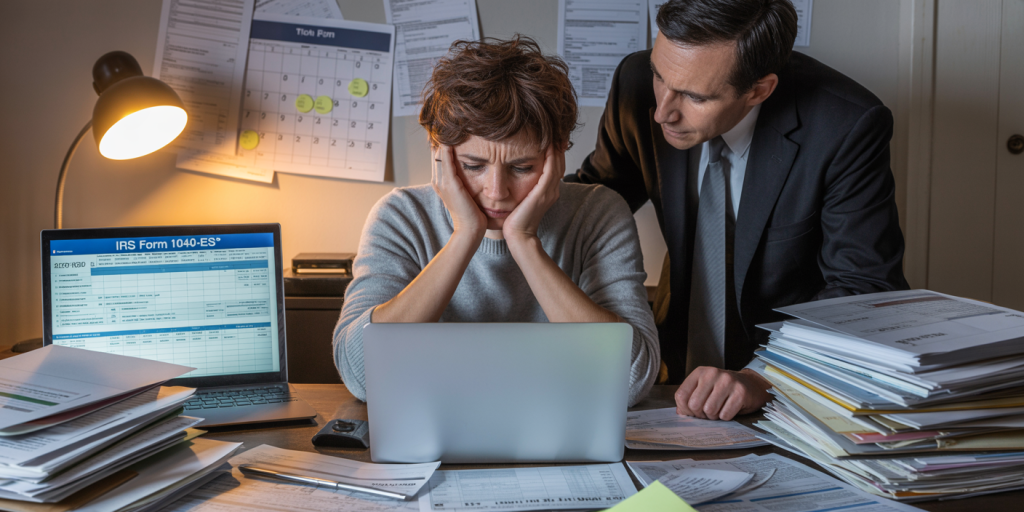

Challenges with Estimated Taxes and Quarterly Payments

Another layer of complexity arises because side hustlers generally do not have taxes withheld from their income. Unlike regular employees who get tax withholding taken from each paycheck, self-employed individuals must estimate and pay their taxes quarterly.

The IRS requires estimated tax payments each quarter if you expect to owe $1,000 or more in tax when your return is filed. Failure to make timely quarterly payments may result in underpayment penalties and interest.

Take the example of James, a software developer who codes on the side for clients. He earned an extra $20,000 in freelance income during the year but ignored quarterly payments, assuming his employer’s withholding would cover his taxes. When filing his return, James faced an unexpected $4,000 tax bill plus $500 in penalties for underpaid estimated taxes.

To avoid such situations, side hustlers must carefully project their expected income and set aside money for estimated quarterly payments. Using tax withholding calculators or consulting with tax professionals can help smooth this process.

Record-Keeping: The Backbone of Tax Compliance

One of the biggest hurdles with side hustles is maintaining accurate and organized records throughout the year. Because side hustle income may come from multiple sources—PayPal accounts, bank transfers, cash payments—tracking each dollar earned and every expense can quickly become overwhelming.

Poor record-keeping can result in underreporting income or forgetting deductible expenses, increasing the risk of audits or overpaying taxes. The IRS emphasizes maintaining detailed and contemporaneous records with receipts, invoices, and mileage logs as a best practice.

For instance, an Etsy seller named Maria became overwhelmed after a successful holiday season. She mixed personal and business expenses in one bank account, lost receipts for material purchases, and failed to track shipping costs thoroughly. This disorganization led to an audit where the IRS disallowed several supposed deductions, increasing her tax liability.

To stay compliant, side hustlers can use simple digital tools and apps geared toward small businesses. Examples include QuickBooks Self-Employed, Expensify, and MileIQ, which automatically categorize expenses and calculate mileage. Setting aside time each week or month to update records minimizes stress come tax season.

Tax Software and Professional Help: When and Why to Seek Them

Tax preparation for those with side hustles can become complicated quickly. While many prefer do-it-yourself (DIY) tax software solutions such as TurboTax or H&R Block, these programs can sometimes miss nuances in self-employment taxes or deductions if users are inexperienced.

Professional tax advisors can bring significant value by helping side hustlers identify all eligible deductions, properly file quarterly estimated payments, and plan for future tax liabilities. Hiring a Certified Public Accountant (CPA) or tax professional may cost between $200 and $600 on average but often saves much more in taxes and penalties.

For example, a recent study by the National Society of Accountants found that taxpayers who used professionals paid 20% less in taxes on average compared to self-preparers with similar income profiles. This is especially true for complex situations involving multiple income streams.

Here is a quick comparison table highlighting pros and cons of tax software vs. professional help for side hustlers:

| Aspect | Tax Software | Professional Tax Preparer |

|---|---|---|

| Cost | $50–$150 per filing | $200–$600 per return |

| Complexity Handling | Basic to moderate complexity | Handles complex situations expertly |

| Time Investment | DIY, time-consuming for beginners | Saves taxpayer’s time |

| Accuracy | Risk of user errors | Guaranteed accuracy to IRS standards |

| Audit Support | Limited | Typically includes representation |

When side hustles grow beyond a few thousand dollars, professional help often becomes a wise investment.

How Tax Laws May Evolve for Side Hustlers in the Future

The gig economy and side hustle culture have drawn increased attention from policymakers and tax authorities alike. The IRS and state agencies are improving systems to better track and tax side income, with more stringent reporting requirements and data-sharing between platforms and government agencies.

For example, starting tax year 2023, the IRS expanded its 1099-K reporting thresholds, requiring third-party payment processors like PayPal to issue forms for any sellers earning over $600 annually, regardless of the number of transactions. This expands reporting obligations and may increase audit triggers.

Additionally, some states are considering implementing or raising thresholds for estimated tax payments and introducing more guidance on deductible expenses unique to gig workers. Transparency and compliance requirements will likely increase, adding pressure on side hustlers to stay organized.

The tax landscape might also evolve to consider universal or simplified withholding for gig economy workers to reduce filing complexities. Meanwhile, technology-driven solutions such as AI-powered tax assistants could become commonplace to aid in filing and compliance.

Preparing for Future Changes

Side hustlers should stay informed about current tax law changes by subscribing to IRS newsletters, monitoring industry-specific news, and periodically consulting tax professionals. Early preparation and consistently maintaining meticulous records will help adapt to shifting regulatory environments.

Using emerging fintech solutions that integrate tax tracking within side hustle platforms can also minimize surprises. Ultimately, treating one’s side hustle as a legitimate business with proper accounting practices will yield the best tax outcomes both now and in the future.

Side hustles offer exciting financial opportunities but introduce substantial tax complications that cannot be ignored. Awareness of additional self-employment tax responsibilities, diligent record-keeping, understanding expenses, and proactively managing quarterly payments are essential for compliance and savings. Whether using tax software or hiring a professional, proper tax preparation for side income is becoming increasingly important as tax regulations evolve alongside the growing gig economy. Taking a proactive and organized approach will empower side hustlers to maximize their earnings while avoiding costly tax pitfalls.