How to Build a Global Investment Portfolio: Diversifying Beyond U.S. Markets

IntroductionIn today’s financial landscape, concentrating all your investments in the U.S. market can mean missing out on growth opportunities, reducing protection against region-specific risks, and overlooking expanding sectors elsewhere in the world. Building a truly global portfolio requires planning, research, discipline, and access to a variety of financial instruments. In this article—structured as a step-by-step guide—we’ll explore how to design a globally diversified investment portfolio, from the reasons you should look beyond the United States to the ongoing rebalancing needed to keep your strategy aligned with your financial goals.

Why Diversify Globally?

Diversification is a cornerstone of any sound investment strategy. By spreading your capital across multiple markets, you reduce exposure to geopolitical shocks, local economic downturns, and adverse currency fluctuations.

- Mitigating idiosyncratic risk

Events specific to a single country—such as political instability, recessions, or regulatory changes—can severely impact the performance of local companies. Holding assets across various economies dilutes that risk. - Access to high-growth sectors

Some technology, healthcare, or renewable energy sectors may have only a small footprint in U.S. markets but represent leadership positions in Asia or Europe. Global investing broadens your opportunity set. - Improved risk-adjusted returns

Studies of historical correlations show that different regions do not always move in sync. Combining assets with low or negative correlation can help your portfolio achieve higher returns for the same risk level. - Inflation and currency hedging

Holding assets denominated in multiple currencies helps protect purchasing power if the dollar weakens or if domestic inflation accelerates.

In short, international diversification is essential for building resilient, sustainable long-term wealth.

Understanding Developed vs. Emerging Markets

Before selecting assets, it’s crucial to distinguish between developed and emerging markets, as each offers distinct risk and return profiles.

- Developed markets

Include the United States, Canada, the U.K., Japan, Germany, France, and other mature economies known for high liquidity, regulatory transparency, and relatively lower volatility. They offer stability but generally more modest growth rates. - Emerging markets

Consist of countries like Brazil, India, China, South Africa, Mexico, and Turkey. These markets can experience faster economic growth but also face greater volatility, political risk, and lower liquidity.

Key considerations

- Volatility

Emerging markets often exhibit larger price swings. Align your allocation with your risk tolerance. - Liquidity

Buying and selling in emerging markets can incur higher costs and longer execution times. - Geopolitical and regulatory risk

Sudden policy shifts, capital controls, or international sanctions can dramatically affect asset values. - Return potential

Higher risk can translate into higher expected returns, especially during periods of rapid economic expansion.

A balanced global portfolio blends the stability of developed markets with the growth potential of emerging ones.

Anúncios

International Asset Classes

Global diversification goes beyond picking stocks from different countries. You should explore multiple asset classes:

- International equities

Represent ownership in foreign companies. You can gain exposure via ADRs (American Depositary Receipts), BDRs (Brazilian Depositary Receipts), or directly through brokers offering access to overseas exchanges. - Foreign fixed income

Sovereign and corporate bonds issued in other currencies—such as German Bunds, U.K. Gilts, Japanese Government Bonds, or Chinese corporate bonds—offer yields that differ from U.S. Treasuries and can hedge against U.S. rate movements. - Global real estate funds (REITs and FIIs)

Provide exposure to property markets—office buildings, hotels, logistics warehouses, residential complexes—across the world, with potential rental income plus capital appreciation. - Commodities and natural resources

Direct investments in gold or oil, or via ETFs and shares of extractive companies in diverse regions. Commodities often serve as inflation hedges and risk diversifiers. - Foreign currencies

Holding a basket of currencies (euro, yen, Australian dollar) can diversify your currency risk and serve as a hedge.

Each asset class has its own risk and correlation profile; combining them enhances portfolio resilience.

4. Global Investment Vehicles

To access these asset classes, consider the following instruments:

- ETFs (Exchange-Traded Funds)

Traded on exchanges, they track regional, sectoral, or asset-class indices. Examples: MSCI EAFE for developed markets in Europe, Australasia, and the Far East; MSCI Emerging Markets; global bond ETFs. - International mutual funds

Actively managed funds that pursue specific country or sector opportunities. They typically carry higher fees than ETFs. - BDRs and ADRs

Certificates that let you invest in foreign companies on your domestic exchange, avoiding the need to open an offshore account. Note their spreads and custody fees. - Global brokerage accounts

Platforms like Interactive Brokers, Charles Schwab, and Fidelity give direct access to U.S., European, and Asian exchanges. Be mindful of transfer costs, tax implications, and compliance. - International real estate investment funds

In some jurisdictions (e.g., Brazil), local funds invest in REITs globally, combining favorable tax treatment with real estate diversification. - Global robo-advisors

Automated services that build and rebalance international portfolios based on your risk profile, charging a flat fee on assets under management.

Choose vehicles that balance cost, convenience, and tax efficiency.

Anúncios

5. Defining Your Asset Allocation

Asset allocation drives long-term performance and risk. To construct your global allocation:

- Risk profile and time horizon

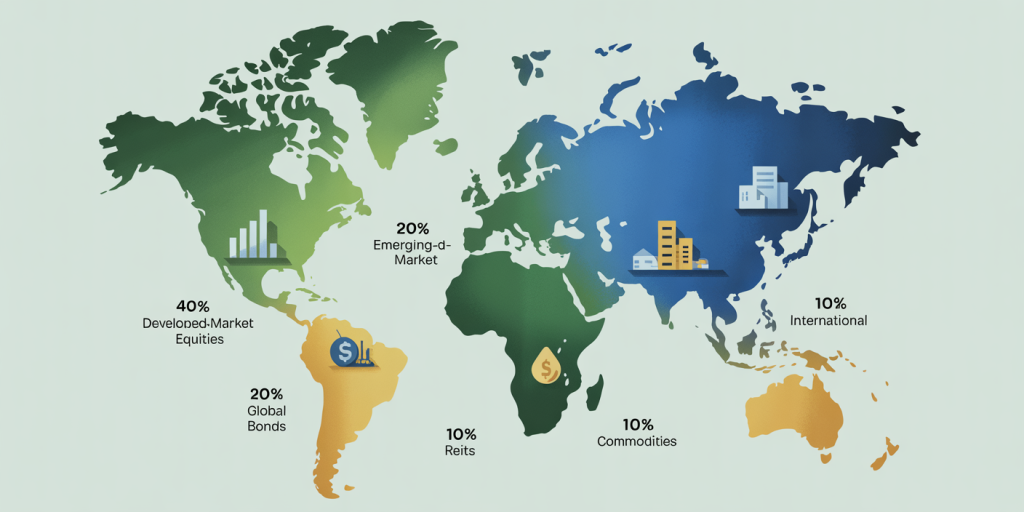

Conservative investors tilt toward international fixed income; aggressive investors overweight emerging equities. Align with your goals—retirement, home purchase, education fund. - Regional diversification

A sample balanced allocation: 40% developed-market equities, 20% emerging-market equities, 20% global bonds, 10% international REITs, 10% commodities. - Currency diversification

Avoid sole dependence on the dollar by including euro, yuan, yen, and pound-denominated assets. - Sector diversification

Global equity exposure naturally spreads you across technology, healthcare, energy, financials, consumer goods, and industrials. - Maximum position limits

Cap any single country at 20% of your portfolio and any individual holding at 5% to prevent concentration risk. - Policy documentation

Write down your allocation policy and rebalancing tolerances to maintain discipline during market turbulence.

A clearly defined allocation guides decisions and simplifies rebalancing.

6. Risk Management and Correlation

Understanding how assets interact is key to minimizing risk:

- Asset correlations

High positive correlation means assets move together; negative correlation means they move in opposite directions. Use historical data to combine assets with low or negative correlation (e.g., emerging equities vs. global bonds). - Stress testing

Simulate historical crisis scenarios (2008 financial crisis, 2020 pandemic) to see how your portfolio would have fared. Many spreadsheets and online tools enable basic backtesting. - Drawdown limits

Set maximum acceptable losses (e.g., 10%, 15%). If reached, review allocation or consider adding currency hedges. - Hedging strategies

Use currency futures or options to hedge significant exposures, understanding that hedging adds cost and complexity. - Counterparty diversification

When investing via derivatives or complex funds, ensure counterparties are creditworthy and well-regulated. - Ongoing monitoring

Track volatility, correlations, and drawdowns to adjust stop-loss rules or rebalancing triggers.

Effective risk management preserves capital and enhances long-term returns.

7. FX Impact and Currency Hedging

Currency movements directly affect your returns:

- Currency risk

Appreciation or depreciation of your home currency (e.g., BRL vs. USD) will amplify or erode foreign gains. - Hedged vs. unhedged vehicles

Some ETFs and funds offer built-in hedges to neutralize currency swings, but they charge extra fees. Unhedged funds leave you fully exposed. - When to hedge

– Short-term outlook: hedge if you expect your home currency to weaken;

– Long-term outlook: many investors leave currency unhedged, as historical FX movements tend to mean-revert. - Hedging instruments

Forwards, futures, swaps, and options can be used, though they require margin and incur roll-over costs. - Cost and liquidity considerations

Major currencies (USD, EUR, JPY) have deep, liquid hedging markets; emerging-market currencies often carry wide spreads. - Natural currency hedges

Holding local bonds or cash in foreign currencies can partially offset FX risk without using derivatives.

Understanding these trade-offs allows you to manage currency risk without undermining your returns.

8. Tax and Regulatory Considerations

Global investing means navigating different tax regimes and regulations:

- Capital gains taxation

In Brazil, gains on BDRs and international ETFs are taxed at 15% on net profit, with exemption for monthly sales under BRL 35,000 (not applicable to BDRs). Foreign brokerage accounts follow similar rules, often 15%–22.5%. - Reporting requirements

You must declare foreign assets (code 49 under “Assets and Rights”) and pay monthly carnê-leão on dividends and gains. Penalties apply for omissions. - Foreign exchange controls

Transfers above USD 10,000 require S-1 registration. Currency remittances entail IOF taxes up to 1.1%. - Local investment restrictions

Some countries limit foreign ownership in strategic sectors or impose withholding taxes on dividends. - Offshore holding companies

Setting up an entity in a neutral jurisdiction (Cayman Islands, Luxembourg) can optimize taxes and broaden product access but incurs setup and compliance costs. - Professional advice

Engage an international tax accountant and legal counsel to navigate complexities and optimize net returns.

A solid tax plan can materially impact your portfolio’s after-tax performance.

Step-by-Step Launch Plan

Here’s how to implement your global diversification strategy:

- Clarify goals and risk profile

Define your time horizon, risk tolerance, and return objectives. Document these guidelines. - Open a brokerage account

Choose a domestic broker offering BDRs/ETFs or open an account with a reputable international platform. - Select investment vehicles

Compile a watchlist of ETFs and funds covering developed markets, emerging markets, global bonds, REITs, and commodities. - Set initial allocation

Based on your profile, assign percentages—e.g., 30% U.S. equities, 20% Europe/Japan equities, 15% emerging equities, 20% global bonds, 10% REITs, 5% commodities. - Dollar-cost average into positions

Use systematic monthly purchases over 3–6 months to mitigate timing risk. - Automate contributions

Schedule recurring investments into your global ETFs/funds to build discipline. - Track expenses

Monitor management fees, trading commissions, and FX spreads to safeguard net returns. - Stay informed

Read global market reports, follow economic news, and join investor communities.

Following these steps helps you avoid common pitfalls and lays a strong foundation.

Rebalancing and Ongoing Oversight

Keeping your portfolio on track requires regular maintenance:

- Rebalancing cadence

Review every six to twelve months or when allocations deviate by more than 5% from targets. - Alert metrics

– Percentage drift from target allocations

– Shifts in volatility and correlations

– Macro developments (interest-rate changes, recession signals) - Rebalancing methods

– In kind: sell over-weighted assets and buy under-weighted ones;

– New contributions/redemptions: direct new cash to under-weighted areas and redeem from over-weighted ones. - Cost considerations

Factor in trading costs, FX spreads, and taxes when deciding the frequency and scale of rebalancing. - Performance tracking

Use spreadsheets or portfolio-tracking software to compare your returns against benchmarks like the MSCI World or FTSE All-World indices. - Strategic adjustments

As you near life-event milestones (e.g., retirement), gradually shift toward lower-risk assets. - Documentation

Keep your investment policy statement and decision logs up to date for accountability and consistency.

Disciplined rebalancing prevents your portfolio from drifting into unintended risks and ensures you systematically buy low and sell high.

Conclusion

Building a global investment portfolio demands study, planning, and discipline. By understanding the nuances of developed versus emerging markets, exploring multiple asset classes, selecting cost-effective vehicles, and managing risks—including currency and tax considerations—you create a robust framework to enhance returns while mitigating volatility. Defining clear asset allocations, committing to regular contributions, monitoring correlations, and rebalancing will help you stay aligned with your long-term goals.

In an increasingly interconnected world, economic growth drivers can shift rapidly across continents. Looking beyond U.S. borders is not merely prudent—it can be decisive in optimizing your wealth accumulation over the coming decades. Start structuring your global portfolio today and position yourself to capture the best opportunities each market has to offer.