How to Create a Debt Repayment Plan That Works

Managing debt can feel overwhelming, but establishing a solid debt repayment plan is a critical step toward financial freedom. According to a 2023 report by the Federal Reserve, American household debt reached $17 trillion, underscoring the need for effective strategies to address repayment. This article explores how to create a practical and effective debt repayment plan, ensuring that you not only reduce your debt but also build a stable financial future.

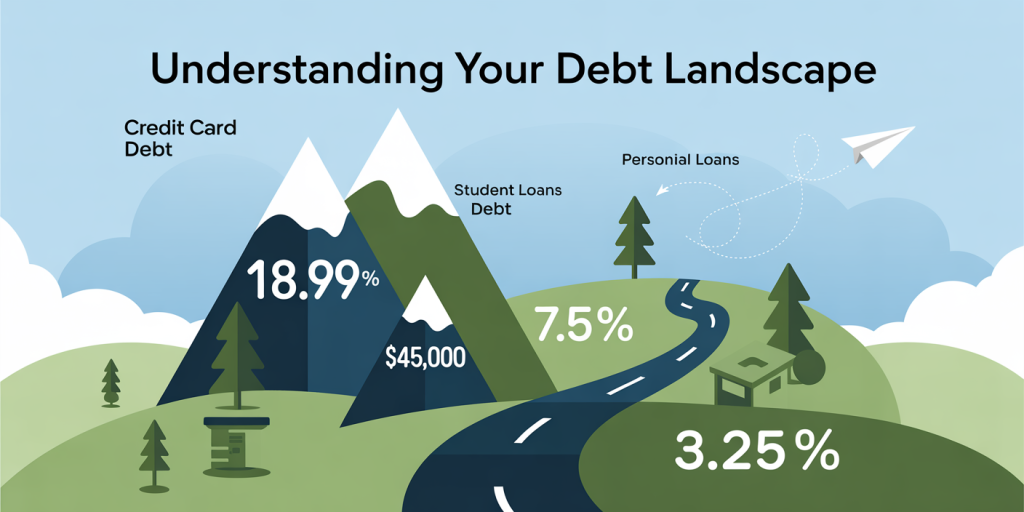

Understanding Your Debt Landscape: The First Step

Before diving into repayment strategies, it’s essential to have a clear picture of your total debt. Debt comes in various forms—credit card balances, student loans, personal loans, mortgages, and more. Each type might have different interest rates, payment terms, and penalties, so compiling all this information is crucial.

Start by listing all your debts with the following details: creditor name, outstanding balance, interest rate, minimum monthly payment, and due date. For example, Jane, a recent college graduate, had three types of debt: a $7,000 student loan at 4% interest, a $3,500 credit card balance at 19% interest, and a $1,000 personal loan at 8% interest. This overview helped Jane prioritize her repayments effectively by spotlighting high-interest debt first.

This debt inventory serves as a foundation for making informed decisions. The clearer you are about your debts, the easier it becomes to allocate your income toward repayment and to avoid missing payments, which can harm your credit score.

Anúncios

Choosing a Repayment Strategy That Fits Your Situation

Once your debts are cataloged, selecting the right repayment method is crucial. Two popular strategies are the debt snowball and debt avalanche methods. Both have benefits depending on your financial habits and goals.

The debt snowball method involves paying off the smallest balance first while making minimum payments on other debts. This method helps build momentum and motivation through quick wins. For instance, a case study from Credit Karma found that 65% of people reported feeling more encouraged to continue repayment when they used the snowball method.

Conversely, the debt avalanche approach prioritizes debts with the highest interest rates. It’s the most cost-efficient method, as it minimizes the total interest paid over time. For example, if you’re juggling a credit card at 20% interest and a personal loan at 10%, paying off the credit card first saves money overall.

Anúncios

| Repayment Method | Focus | Advantages | Suitable For |

|---|---|---|---|

| Debt Snowball | Smallest balance first | Quick psychological wins | Those needing motivation |

| Debt Avalanche | Highest interest first | Saves the most on interest payments | Those focused on cost-saving |

Deciding which method to employ depends on whether your priority is psychological momentum or financial optimization.

Crafting a Realistic Monthly Budget

An effective debt repayment plan relies on a budget that balances your income, expenses, and debt payments. Without a comprehensive budget, unexpected costs may derail your repayment progress.

Begin by tracking your monthly income and fixed expenses—rent, utilities, groceries, transportation—over at least one month. Then, identify discretionary spending that can be reduced or eliminated. For example, Sarah, a mid-30s professional, cut her dining out budget by 50% and redirected those savings towards her credit card minimum payments plus an extra $150 monthly, accelerating her debt payoff timeline by a year.

Budgeting apps like YNAB (You Need a Budget) or Mint can assist in highlighting spending patterns and provide alerts when you approach preset limits. According to a 2022 survey by NerdWallet, users of budgeting tools were 30% more likely to stay on track with their debt repayment goals.

Incorporate your chosen repayment method into the budget by assigning specific amounts for each debt. Maintain flexibility to accommodate emergencies but aim to keep your repayment plan on schedule.

Negotiating With Creditors and Exploring Refinancing Options

Not all debt repayment plans involve solely paying what you owe on original terms. Negotiating with creditors or refinancing can provide relief, especially when interest rates are high or your financial situation changes.

Contact your creditors to discuss options such as lowering interest rates, waiving late fees, or restructuring payments. In a documented case by the Consumer Financial Protection Bureau (CFPB) in 2023, a borrower successfully negotiated a 3% interest reduction on a $10,000 credit card balance, saving over $300 in interest over the year.

Refinancing is another tool that can reduce interest rates or extend repayment timelines. For example, consolidating high-interest credit card debts into a single personal loan with a lower interest rate can simplify payments and lower monthly obligations. However, be cautious of longer terms that may increase total interest paid over time.

A comparative overview:

| Option | Typical Benefits | Potential Drawbacks |

|---|---|---|

| Creditor Negotiation | Lower interest, waived fees, better terms | May affect credit score if handled poorly |

| Refinancing | Lower interest rates, simplified payments | Possible fees, longer repayment period |

Being proactive in communication with creditors often opens doors to more manageable repayment conditions.

Tracking Progress and Adjusting Your Plan

A debt repayment plan isn’t static; it requires ongoing monitoring and adjustment. Set monthly check-ins to assess your remaining balances, track any reduction in interest or fees, and adjust your budget as necessary.

Tools like Excel spreadsheets or financial apps can visualize your debt payoff progress through graphs and timelines. Seeing a declining debt chart can provide motivation and reinforce discipline.

If you encounter unexpected expenses—medical bills or car repairs—it may be necessary to temporarily adjust payments, prioritizing minimum payments to avoid penalties. On the other hand, receiving bonuses or tax refunds can allow for extra lump sum payments that reduce principal balances faster.

A practical example is Tom, who faced a sudden job loss but kept making minimum payments to avoid damage to credit. After reemployment, he increased payments to his debt avalanche plan, reducing his overall debt two years earlier than projected.

Consistency and flexibility are key pillars of a sustainable debt repayment plan.

Looking Ahead: Building Financial Resilience Post-Debt

Successfully repaying debt is just one milestone; creating long-term financial resilience is the next. After clearing debts, many experts recommend shifting focus toward emergency savings, retirement contributions, and investment growth.

Statistics from the National Financial Educators Council in 2023 indicate that individuals with an emergency fund covering at least three months of expenses are 50% less likely to accumulate debt again after repayment.

In addition, continuing to live within the budget discipline developed during the repayment phase can help avoid the debt cycle. Automation of savings and investments cultivates wealth that compensates for inflation and increases future financial options.

Planning ahead also includes reviewing credit reports regularly to maintain a high credit score, which reduces borrowing costs if new credit is needed.

In essence, the skills and habits formed through a structured debt repayment plan serve as the foundation for a stable and prosperous financial future.

—

Creating a debt repayment plan that works requires a clear understanding of your debts, choosing a suitable repayment strategy, budgeting effectively, negotiating or refinancing when possible, tracking progress meticulously, and preparing for future financial stability. By applying these principles, individuals can transform debt from a source of stress into a manageable challenge with lasting benefits.