How to Rebalance Your Portfolio: When and Why It Matters

In the world of investing, portfolio management is crucial to achieving long-term financial goals. One of the most essential yet often overlooked aspects of maintaining an investment portfolio is rebalancing. Portfolio rebalancing involves realigning the proportions of assets in your portfolio to match your desired risk tolerance and investment objectives. This practice helps mitigate risk, lock in profits, and maintain a strategic investment approach as market conditions evolve.

Understanding when and why to rebalance your portfolio not only protects your investments from becoming overly exposed to particular asset classes but also ensures that your strategy remains aligned with your financial goals. Without rebalancing, a portfolio can drift away from its intended risk profile, potentially exposing investors to unintended risk or missed opportunities. This article explores the critical aspects of portfolio rebalancing including the ideal timing, methods, benefits, and future considerations every investor should know.

The Importance of Rebalancing: Why It Matters

Portfolio rebalancing is essential because financial markets rarely move uniformly. Different asset classes such as stocks, bonds, and commodities perform variably depending on economic cycles, interest rates, geopolitical events, and other factors. Consequently, the original asset allocation—which reflects the investor’s risk tolerance and goals—may become distorted over time. For example, if stocks outperform bonds for a period, their increased weight could mean the portfolio is now riskier than intended.

Research shows that maintaining a disciplined rebalancing schedule can improve returns and reduce the likelihood of major losses. According to a Vanguard study, portfolios that were rebalanced annually over a 20-year period had a higher risk-adjusted return compared to those left unattended. By rebalancing, investors essentially “buy low and sell high,” trimming down over-performing assets and reinvesting in under-performing ones to maintain balance.

Anúncios

Beyond returns, rebalancing helps investors avoid emotional decision-making amid market fluctuations. Without a clear plan, investors might chase outperforming assets or panic during downturns, both of which can be detrimental long-term. Rebalancing serves as a systematic check-in, helping maintain discipline and adherence to an evidence-backed investment strategy.

When to Rebalance: Timing Strategies Explained

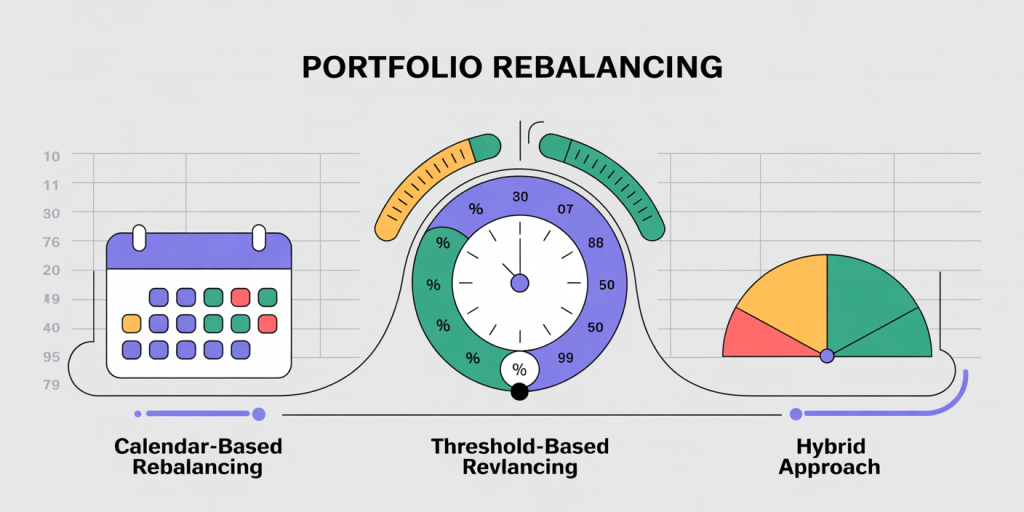

Knowing when to rebalance is as critical as understanding why it’s necessary. There are three primary approaches: calendar-based, threshold-based, and hybrid methods. Calendar-Based Rebalancing: This method involves reviewing and adjusting the portfolio at fixed intervals such as quarterly, semi-annually, or annually. For instance, an investor might rebalance every December regardless of market movements. Calendar rebalancing is easy to implement and prevents neglect, especially among passive investors. However, it may lead to unnecessary trades if market fluctuations are minor, increasing transaction costs. Threshold-Based Rebalancing: In this technique, rebalancing occurs only when asset weights deviate beyond predetermined tolerances, for example, a 5% or 10% deviation from the target allocation. This method targets significant drift and can be more cost-efficient, avoiding frequent trading during normal volatility. For example, if a portfolio target for stocks is 60%, a threshold rebalancing rule might trigger adjustments only when stocks’ share exceeds 65% or drops below 55%. Hybrid Approach: Combining calendar and threshold tactics, investors periodically review the portfolio but rebalance only if deviations surpass the set thresholds. This strategy helps balance transaction costs with risk control, optimizing the decision-making process.

Anúncios

A practical example: a 2021 report from BlackRock suggests that rebalancing annually or semi-annually with a 5% band tends to optimize performance and cost-efficiency for most retail investors. The key is choosing a method that aligns with your investment style and cost sensitivity.

Methods of Rebalancing: Practical Strategies

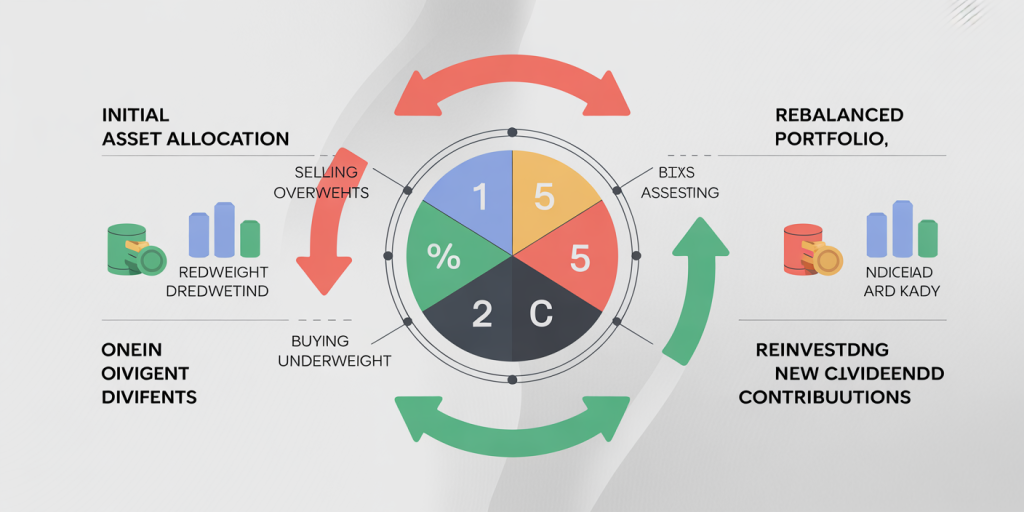

Once the timing decision is made, investors must choose how to rebalance. There are several common methods:

1. Selling Overweight Assets and Buying Underweight Ones: The most straightforward approach involves selling securities that have grown disproportionately and using the proceeds to purchase those lagging. For instance, if stocks have increased from 60% to 70%, you might sell 10% and buy bonds or cash equivalents. This method incurs transaction costs and could trigger capital gains taxes in taxable accounts.

2. New Contributions or Dividends Allocation: Instead of selling, investors can use new cash inflows such as paychecks or dividends to buy more of the underweight assets. This method minimizes selling and tax consequences, making it popular among long-term investors who regularly add funds.

3. Combination of Selling and Buying: Some investors combine both strategies: selling some overweights and allocating incoming funds to underweights. This offers a balanced way to rebalance while managing tax implications and transaction costs.

To illustrate, consider a portfolio of $100,000 with a target allocation of 60% stocks and 40% bonds. After a bull market, stocks increase to 70% ($70,000), and bonds drop to 30% ($30,000). To rebalance:

| Asset Class | Actual Value | Target Value (60/40) | Action |

|---|---|---|---|

| Stocks | $70,000 | $60,000 | Sell $10,000 worth of stocks |

| Bonds | $30,000 | $40,000 | Buy $10,000 worth of bonds |

This realignment restores the portfolio risk profile consistent with the initial plan.

Benefits of Rebalancing: Risk Management and Performance

Rebalancing delivers multiple benefits, primarily risk management and enhanced portfolio performance. By maintaining target allocations, investors control risk exposure effectively. A portfolio skewed excessively toward equities during a market peak may suffer severe losses during a correction, while a conservative approach ensures capital preservation.

Moreover, rebalancing can enhance returns through systematic contrarian behavior—selling high and buying low. Historical data supports this advantage. A study published in the Financial Analysts Journal demonstrated that a quarterly rebalanced portfolio produced average annualized returns 0.29% higher than a buy-and-hold strategy from 1926 to 2010 in U.S. equities.

Another advantage is psychological discipline. During turbulent markets, investors may feel compelled to abandon their plans. Rebalancing enforces a rules-based approach, reducing emotional decisions and panic selling.

Consider the 2008 financial crisis: investors with strict rebalancing policies may have sold some bonds and bought equities during the downturn, positioning themselves better for the subsequent market recovery. Conversely, neglecting rebalancing might have led to a portfolio overly diluted in equities, increasing vulnerability.

| Benefit | Description | Example |

|---|---|---|

| Risk Control | Maintains asset allocation, preventing unwanted risk exposure | Prevents overweight in volatile stocks |

| Enhanced Returns | Systematic buying low and selling high | Quarterly rebalancing adds 0.29% annual return |

| Emotional Discipline | Avoids impulsive rash decisions | Sticks to strategy during 2008 crisis |

Practical Challenges and How to Overcome Them

Despite the clear benefits, investors encounter obstacles in rebalancing. One challenge is transaction costs, including brokerage fees and taxes, particularly in taxable accounts. Frequent buying and selling may erode returns if not managed prudently. To mitigate this, investors can limit rebalancing frequency or thresholds, employ tax-advantaged accounts, or focus on using dividends and contributions for adjustments.

Another difficulty arises from market timing temptation. Some investors resist rebalancing during bull runs fearing missed gains or await market bottoms to rebalance — strategies that conflict with the purpose of rebalancing. Sticking to predetermined rules based on objective criteria can help overcome this behavioral bias.

Additionally, the complexity grows with diversified portfolios, including international equities, alternative assets, and sector-specific funds. Utilizing portfolio management software or consulting financial advisors may be beneficial for accurate, timely rebalancing.

Looking Ahead: The Future of Portfolio Rebalancing

Technological advances and evolving market structures are transforming portfolio rebalancing in several ways. Robo-advisors such as Betterment and Wealthfront use automated algorithms to rebalance portfolios continuously or at optimal times, often minimizing tax impacts through tax-loss harvesting strategies. This democratizes access to disciplined rebalancing for retail investors.

Additionally, the rise of ESG (Environmental, Social, and Governance) investing introduces new layers to portfolio design and rebalancing. Investors increasingly seek to maintain allocations not only by asset class but also by sustainability metrics, necessitating advanced rebalancing tools.

Furthermore, dynamic asset allocation models, which adjust targets based on economic indicators or market valuations, are gaining traction. These “smart rebalancing” approaches aim to improve risk-adjusted returns beyond static allocation frameworks.

Despite innovations, the core principle remains: rebalancing is crucial for aligning portfolios with investor goals. As markets evolve, combining automated tools with human judgment will likely define best practices moving forward.

—

In summary, rebalancing your portfolio is neither optional nor trivial—it is a foundational practice for long-term investment success. By understanding the timing, methods, associated benefits, and challenges, investors can implement effective strategies that control risk and harness market opportunities. Embracing emerging technologies and evolving methodologies will only enhance this age-old investment discipline, helping investors stay on track amid an ever-changing financial landscape.