The Power of Compound Interest: Start Early, Retire Rich

In the realm of personal finance, few concepts are as impactful and transformative as compound interest. While many understand the basic idea of earning interest on savings, the true power of compounding—earning interest on interest—can significantly enhance wealth accumulation over time. Starting early with investment and savings strategies that harness this force can mean the difference between modest retirement funds and financial independence. This article explores the mechanics of compound interest, presents practical examples and data-driven insights, and highlights why early action is crucial for a rich retirement.

Understanding Compound Interest and Its Impact

Compound interest refers to the process where the interest earned on an investment is reinvested, generating additional earnings over subsequent periods. Unlike simple interest, which applies only to the principal amount, compound interest grows exponentially because it applies to the accumulated principal plus previously earned interest. This phenomenon accelerates wealth growth, particularly over longer time horizons.

Anúncios

For example, if you invest $1,000 at an annual interest rate of 5%, simple interest would yield $50 each year, totaling $1,500 after 10 years. However, with compound interest, the amount grows to approximately $1,629 in the same period, and the gap widens as years go by. The magic lies in reinvesting returns, which snowballs wealth. As Albert Einstein reportedly said, “Compound interest is the eighth wonder of the world.”

Anúncios

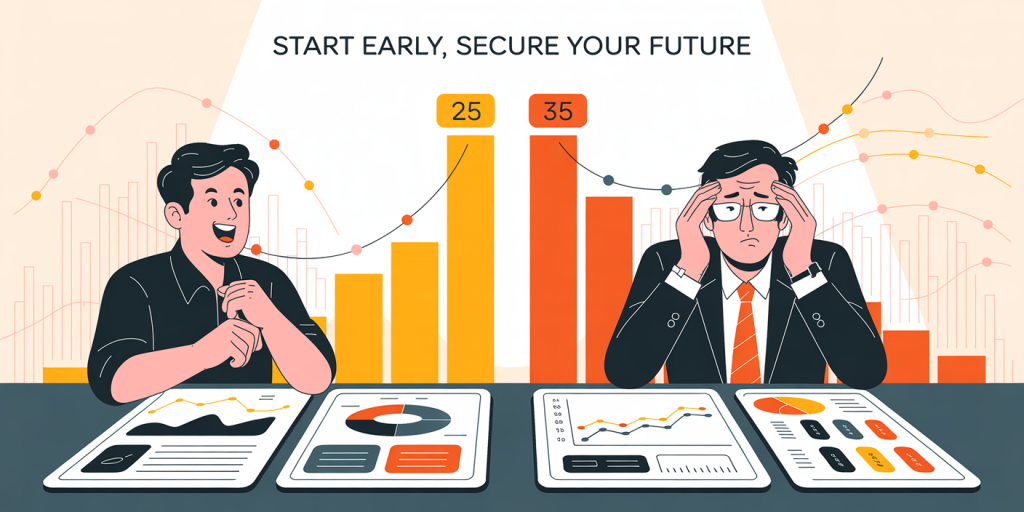

How Starting Early Multiplies Wealth: A Practical Analysis

Starting early is a game-changer in leveraging compound interest. The longer your money stays invested, the more periods it has to compound, resulting in larger final amounts. Consider two investors: Alice begins investing $2,000 annually at age 25, while Bob starts the same investment at age 35. Assume an average annual return of 7% compounded yearly, and both contribute until age 65.

| Investor | Start Age | Years Contributing | Total Contributions | Final Portfolio Value at 65 |

|---|---|---|---|---|

| Alice | 25 | 40 | $80,000 | ~$444,000 |

| Bob | 35 | 30 | $60,000 | ~$151,000 |

Alice’s starting advantage of a mere decade results in almost three times Bob’s wealth at retirement, despite contributing only $20,000 more over the entire period. This underscores how even modest delays can significantly undermine long-term wealth potential due to the diminishing power of compounding with fewer time periods.

Historically, the stock market has averaged about 7% annual real returns after inflation, which makes it an ideal example for compounding investments. Time allows returns to grow upon returns, magnifying the difference between early and late investing.

Types of Investments That Benefit from Compounding

Not all investments compound equally or consistently. Savvy investors choose vehicles that maximize the advantage of compound interest while managing risk and liquidity. Savings accounts, bonds, stocks, mutual funds, exchange-traded funds (ETFs), and retirement accounts like 401(k)s and IRAs all leverage compounding, albeit at different rates.

High-Yield Savings Accounts offer compound interest but generally feature low annual percentage yields (APYs) around 0.5% to 2% as of recent years, making them suitable for short-term goals and emergency funds rather than significant wealth accumulation.

In contrast, equities and equity-based funds historically deliver more robust average returns—around 7-10% annually—though with higher volatility. Tax-advantaged accounts such as Roth IRAs and 401(k)s provide additional compounding benefits because earnings grow tax-free or tax-deferred, enabling investors to reinvest more of their gains.

For instance, a Roth IRA invested in an S&P 500 index fund compounding at roughly 8% annually for 30 years can grow an initial $10,000 contribution to more than $100,000, tax-free at withdrawal. This highlights the power of combining compounding with tax benefits.

Overcoming Common Challenges to Start Early

Despite its benefits, many people delay investing due to perceived barriers like insufficient funds, fear of risk, or lack of knowledge. However, compounding benefits can be captured with even small, consistent investments over time. Platforms offering fractional shares and automated investments have lowered entry thresholds, making early compounding accessible.

For example, investing just $50 per month starting at age 20 at a 7% annual return results in more than $100,000 by age 65. If started at age 30 under the same terms, the amount drops to approximately $48,000, less than half the value—illustrating the importance of momentum.

Moreover, education around risk tolerance and investment options can empower investors to build diversified portfolios tailored to their comfort levels, gradually improving returns while limiting potential losses.

Behavioral science studies indicate that setting up automated contributions increases the likelihood of sustained investing habits. Taking such steps early bypasses the emotional hurdles of market timing and procrastination.

Compound Interest in Real-Life Success Stories

Many real-world examples illustrate the power of compounding to achieve significant wealth. Take Warren Buffett, one of the richest individuals globally, who began investing in his early teens. His wealth growth over decades demonstrates compound interest magnified by savvy reinvestments and business acumen.

Similarly, Catherine, a schoolteacher who consistently invested $200 monthly into a diversified mutual fund from age 25 to 40 and then stopped, reaped the benefits years later. By age 65, her portfolio reached approximately $400,000, proving that even stopping contributions early can still yield substantial funds if the initial time frame included compounding.

Such stories reinforce the notion that disciplined, early investing combined with patience can translate into retirement security or financial freedom.

Future Perspectives: Embracing Compound Interest in a Changing Financial Landscape

Looking ahead, compound interest principles remain as relevant as ever, but the context in which individuals invest is evolving. Advances in financial technology (fintech) offer unprecedented access to low-cost investment platforms, robo-advisors, and real-time market data, making it easier for individuals to start early and optimize compounding.

Moreover, increasing longevity means people may need larger retirement funds to sustain longer post-work lives, emphasizing the importance of maximizing compound growth through early and sustained investing.

However, accelerating global economic shifts and market volatility require investors to remain informed and adaptable. Diversification, periodic portfolio rebalancing, and continued financial education are critical to sustain compounding’s benefits amidst shifting conditions.

Furthermore, emerging investment vehicles like cryptocurrencies are attracting attention for their high growth potential but come with increased risk volatility. Their inclusion in portfolios deserves careful consideration to balance growth and safety.

Governments and employers are also expanding access to retirement savings plans with match incentives and tax advantages, which, when leveraged properly, can supercharge compound interest effects.

Comparative Table: Investment Growth Over 30 Years at 7% Annual Compound Interest

| Initial Investment | Monthly Contribution | Total Investment | Value After 30 Years |

|---|---|---|---|

| $5,000 | $100 | $41,000 | ~$94,000 |

| $10,000 | $200 | $83,000 | ~$187,000 |

| $0 | $300 | $108,000 | ~$204,000 |

This table illustrates how combining initial capital with consistent monthly contributions over long periods results in substantially compounded growth, reinforcing why early and persistent saving matters.

—

Harnessing the power of compound interest to retire rich requires an understanding of how to start early, choose appropriate investments, and maintain consistent contributions despite market fluctuations. The earlier and more disciplined you commit to investment growth, the more you harness compounding’s exponential benefits. With financial tools evolving and retirement needs increasing, embracing compounding now offers a pathway to lifelong financial security and independence.