Understanding Capital Gains Tax When Selling Your Home or Stocks

Capital gains tax (CGT) stands as a crucial aspect of financial planning, whether you’re selling real estate or disposing of investments like stocks. Navigating the complexities of CGT can help individuals maximize profits and minimize tax liabilities. This article provides an in-depth guide to understanding capital gains tax, covering key concepts, practical examples, and data-driven insights on both residential property and stock transactions.

The Fundamentals of Capital Gains Tax

Capital gains tax is imposed on the profit realized from the sale of a capital asset, such as a home or stock. The tax applies to the difference between the selling price and the original purchase price (the “cost basis”), after accounting for allowable adjustments like improvement costs or commissions. Understanding how CGT works can help taxpayers prepare for financial obligations tied to asset sales.

For instance, if you purchase stocks at $10,000 and sell them for $15,000, the $5,000 gain is subject to capital gains tax. Similarly, when selling a home bought for $300,000 and sold at $400,000, the $100,000 gain may be taxable depending on several factors, including residency and use of the property.

The capital gains tax rates vary depending on whether the assets were held for a short-term (typically less than one year) or long-term (more than one year) period. Short-term gains are generally taxed at ordinary income tax rates, which can be higher, while long-term gains benefit from reduced rates.

Anúncios

Capital Gains Tax on Home Sales

The taxation of capital gains on home sales involves specific exemptions and conditions, distinguishing it from other asset classes. In many jurisdictions, the sale of a primary residence can be exempt from capital gains tax up to a certain threshold to protect homeowners from burdensome tax liabilities.

For example, in the United States, the IRS allows an exclusion on up to $250,000 of capital gains for single filers and $500,000 for married couples when selling their primary home, provided they have lived in the property for at least two of the previous five years. This rule helps millions avoid hefty tax bills on the profit earned from their homes.

However, if you sell a second home, rental property, or do not meet the residency requirements, the gains may be fully taxable. Additionally, improvements made to the property that increase its value can increase the cost basis, thereby reducing taxable gains.

Real Case Study: Consider a couple who bought a home in 2010 for $350,000 and sold it in 2024 for $600,000. They lived in the home continuously for over two years before selling. They are eligible for the $500,000 exclusion. Their gain is $250,000 ($600,000 – $350,000), which falls under the exclusion threshold, meaning no capital gains tax is owed.

Capital Gains Tax on Stocks

When selling stocks, understanding the distinction between short-term and long-term capital gains becomes essential. Short-term capital gains—profits on stocks held for one year or less—are taxed at the individual’s ordinary income tax rate, which can be as high as 37% in the highest U.S. tax brackets. Long-term capital gains benefit from more favorable rates, typically 0%, 15%, or 20%, based on income levels.

Anúncios

To illustrate, consider Sarah, who bought $20,000 worth of shares in a tech company. After 10 months, the stock value increased to $28,000, and she sold it, realizing an $8,000 short-term gain taxed at her ordinary income rate of 24%. She owes $1,920 in taxes ($8,000 * 24%). Had she waited another two months to hold the shares for over a year, her $8,000 gain would be taxed at the long-term rate of 15%, reducing her tax liability to $1,200.

This example stresses the importance of timing stock sales to capitalize on lower tax rates.

Tax-Loss Harvesting Strategy

One effective technique used in managing stock portfolios is tax-loss harvesting. This involves selling investments at a loss to offset capital gains realized elsewhere, thereby reducing the overall tax burden. If losses exceed gains, investors can deduct up to $3,000 of the excess loss against ordinary income, with remaining losses carried forward to future tax years.

In recent years, tax-loss harvesting has been popularized by robo-advisors and wealth management platforms, leveraging algorithms to systematically sell losing positions towards year-end to reduce taxable gains.

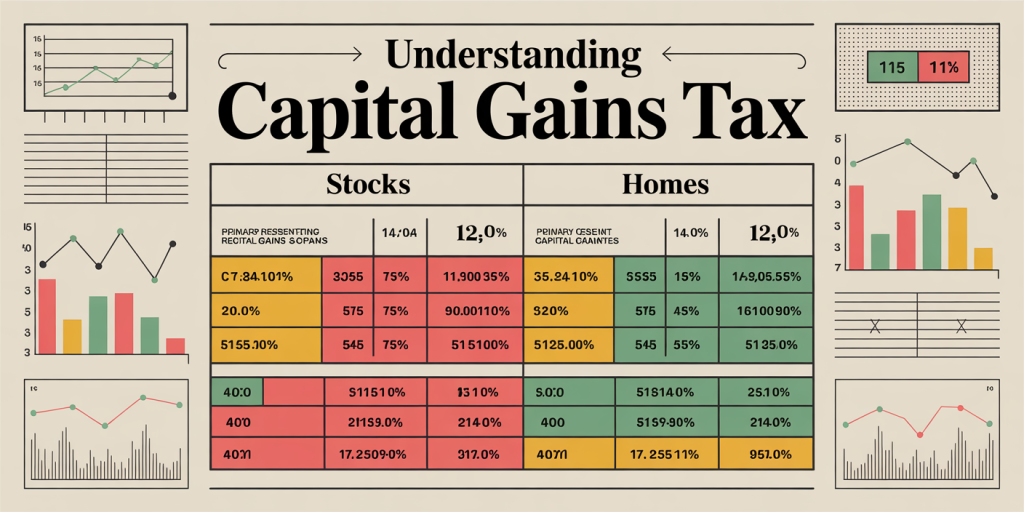

Comparative Overview of Capital Gains Tax Rates

The following table summarizes the federal capital gains tax rates for home sales and stock sales in the U.S., highlighting key rate differences based on asset type and holding period.

| Asset Type | Holding Period | Tax Rate | Exclusion/Allowance |

|---|---|---|---|

| Primary Residence | N/A | Excluded up to $250K / $500K gain | Must live 2 of last 5 years |

| Stocks | Short-term (<1 year) | Ordinary income tax rates (10%-37%) | No exclusion |

| Stocks | Long-term (≥1 year) | 0%, 15%, or 20% depending on income | No exclusion |

This comparative insight helps demonstrate how capital gains tax treatment varies significantly by asset type and individual circumstances.

Reporting and Documentation for Capital Gains

Accurate record-keeping is paramount for calculating capital gains tax correctly. Taxpayers must retain purchase receipts, sales records, statements of reinvestment, and documentation of any improvements or adjustments made to properties or shares.

For homes, keep records of purchase price, selling expenses (such as agent commissions and closing costs), and receipts for renovations or substantial improvements, as these can increase the cost basis, lowering taxable gains.

For stock transactions, brokerage statements typically report cost basis and sales proceeds, but investors should verify these against personal records, especially if shares were acquired in multiple batches at varying prices. Mistakes in reporting can lead to audits and penalties.

When preparing tax returns, capital gains and losses are generally reported on Schedule D and Form 8949 (in the U.S.). Understanding these forms or seeking professional advice can minimize errors and optimize tax liabilities.

Real-World Data: Capital Gains Tax collection and Trends

According to the U.S. Internal Revenue Service data, capital gains tax collections amounted to approximately $360 billion in fiscal year 2022, representing a significant portion of the overall federal tax revenue. This highlights the substantial impact of CGT on the economy and individual taxpayers.

Studies also show that homeowners benefit greatly from the primary residence exclusion; nearly 90% of home sellers avoid capital gains tax due to the exclusion and favorable market appreciation trends. Meanwhile, stock market investors are increasingly aware of long-term investing benefits, both in capital gains rates and investment growth.

Data from the Investment Company Institute reports average annualized total returns of the S&P 500 at around 10% over the last 30 years, underscoring the potential gains subject to capital gains taxation for stockholders.

Planning for the Future: Evolving Capital Gains Tax Landscape

Looking ahead, capital gains tax policies remain dynamic, often influenced by political and economic factors. Recent legislative proposals in several countries aim to increase capital gains tax rates, particularly targeting high-income taxpayers and significant investment gains to address wealth inequality and fund public initiatives.

For instance, the Build Back Better Act proposed in the U.S. suggested increasing the top long-term capital gains tax rate to 25%, though it has not been enacted as of mid-2024. Paying attention to legislative developments and understanding their implications will be crucial for taxpayers.

Moreover, new technologies in tax software and robo-advisors promise to simplify capital gains tax reporting and optimize tax strategies, enabling investors and homeowners to make informed decisions with greater ease.

Taxpayers should maintain ongoing dialogue with financial advisors and tax professionals to adapt to evolving rules, maximize exclusions, and emulate strategies like tax-loss harvesting and holding period management effectively.