Understanding Risk vs. Reward in Your Investment Strategy

Investing is inherently about managing a delicate balance between risk and reward. Every financial decision an investor makes requires weighing the potential gains against the likelihood and severity of possible losses. This fundamental principle, often referenced as the risk-reward tradeoff, guides investment behaviors across markets, assets, and economic cycles. Developing a clear understanding of how risk and reward interact within various investment strategies is crucial for optimizing returns while maintaining an acceptable level of exposure to uncertainties.

The dynamics between risk and reward can shape portfolio performance dramatically. For instance, risk-taking can lead to high returns during bullish markets but may also result in significant losses during downturns. Conversely, overly conservative approaches might protect capital but limit growth potential. Thus, recognizing the nature of risks, accurately assessing expected rewards, and aligning investment choices with personal financial goals and risk tolerance are essential components of successful wealth management.

Anúncios

Defining Risk and Reward in Investment Terms

Risk refers to the possibility of losing some or all of the original investment or the variability in returns that could lead to underperformance. It is often quantified through volatility measures such as standard deviation or beta, which reflects sensitivity to market movements. For example, stocks of technology companies generally exhibit higher volatility than government bonds, indicating greater risk. However, these stocks also tend to offer higher potential returns, signifying the intertwined nature of risk and reward.

Anúncios

Reward, in an investment context, pertains to the financial gain that results from the appreciation of an asset’s value or income generated through dividends or interest. The expected reward is influenced by factors like market conditions, asset class, and investment horizon. For example, the annualized return for the S&P 500 Index between 1926 and 2023 averages around 10%, but actual returns fluctuate yearly, exposing investors to varying degrees of reward and risk.

Understanding that risk cannot be eliminated but must be managed provides a foundation for constructing robust investment strategies. Investors need to assess the types of risks — market risk, credit risk, liquidity risk, inflation risk, among others — and evaluate how these impact the potential reward of different investment options.

The Relationship Between Risk and Reward: A Quantitative Perspective

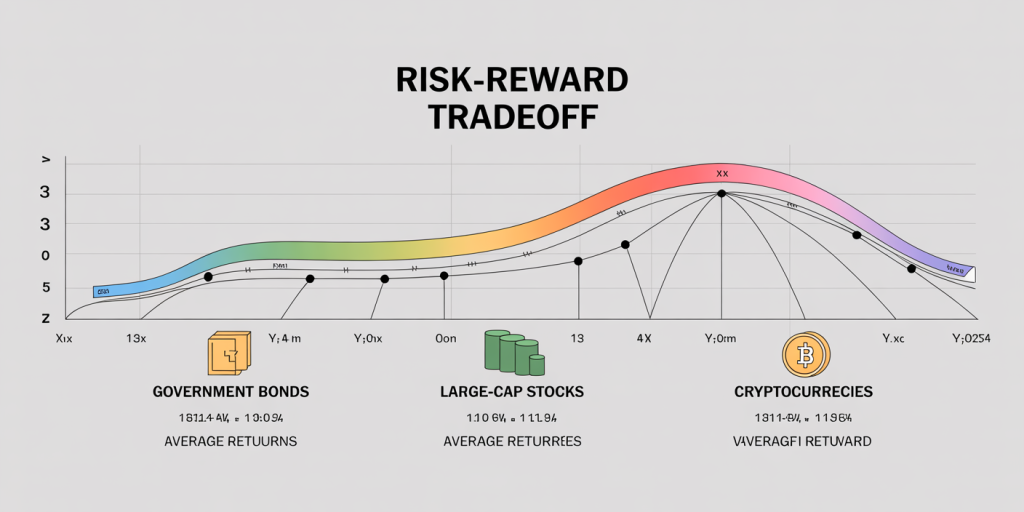

The classic financial theory asserts that higher risks should correspond with higher expected rewards. This concept is visually represented as the risk-reward curve or plot, illustrating how increasing risk levels typically raise the anticipated return, albeit with more uncertainty.

Consider the following comparative table highlighting different asset classes, their risks (standard deviation), expected annual returns, and examples:

| Asset Class | Average Annual Return (%) | Standard Deviation (%) | Example |

|---|---|---|---|

| U.S. Government Bonds | 3.5 | 4.0 | 10-Year Treasury Bonds |

| Large-Cap Stocks | 10.0 | 15.0 | S&P 500 Index |

| Small-Cap Stocks | 12.5 | 22.0 | Russell 2000 Index |

| Emerging Markets | 13.0 | 25.0 | MSCI Emerging Markets |

| Cryptocurrency | 50+ | 80+ | Bitcoin, Ethereum |

As the table indicates, more volatile assets like cryptocurrencies possess potential for outsized rewards but are accompanied by significant risk and price swings. Conversely, government bonds offer stability and lower returns, appealing to conservative investors focused on capital preservation.

Real-world cases bolster this concept: during the 2008 financial crisis, investors heavily invested in equities suffered massive losses due to market risk, with the S&P 500 losing nearly 37% that year. Conversely, government bonds provided a safe haven, offering positive or minimal negative returns during turmoil. Balancing between these asset classes enables investors to tailor portfolios to desired risk-return profiles.

Measuring and Managing Risk in Your Portfolio

Effective risk management begins with measuring risk quantitatively, often through volatility, Value at Risk (VaR), and stress testing. Volatility measures the dispersion of returns, but it doesn’t capture the full spectrum of downside risk. VaR estimates the maximum expected loss over a specific time frame at a given confidence level, helping investors understand potential worst-case scenarios.

For example, a portfolio with a VaR of $10,000 at 95% confidence means that there is only a 5% chance the portfolio will lose more than $10,000 over the defined period. Large financial institutions routinely use VaR to allocate capital reserves and set risk limits.

Managing risk involves diversification, asset allocation, and using hedging instruments. Diversification across asset classes and geographic regions reduces idiosyncratic risk. For instance, combining equities with government bonds, commodities, and real estate investments smooths portfolio volatility.

Hedging with options and futures contracts can protect against adverse price movements but also introduces costs and complexity. The use of stop-loss orders, position sizing, and periodic rebalancing further enhances risk control.

Practical Examples of Risk vs. Reward Balancing

Case Study: Warren Buffett’s Investment Approach

Legendary investor Warren Buffett emphasizes value investing, focusing on companies with strong fundamentals, solid earnings, and reasonable valuations, aiming to minimize downside risk. Buffett’s investments in companies like Coca-Cola and Apple reflect calculated risk-taking tempered by diligent research.

During the 2020 market downturn triggered by the COVID-19 pandemic, Buffett’s Berkshire Hathaway maintained significant cash reserves, avoiding panic selling. While this conservative approach may limit explosive gains during bull markets, it mitigates risk during uncertainty, illustrating disciplined management of risk versus reward.

Individual Investor Scenario

Imagine two investors: Alice, a 25-year-old saving for retirement, and Bob, a 60-year-old about to retire. Alice opts for a weighted portfolio tilted towards stocks (80%) to maximize potential rewards over the long term, accepting volatility and short-term losses. Bob prefers a conservative allocation with 30% stocks and 70% bonds to protect capital and generate steady income.

Their risk tolerance and reward expectations vary, showing how age, financial goals, and risk appetite influence investment strategy. Studies from Vanguard show that balanced portfolios (60% stocks, 40% bonds) historically provide moderate returns (~7-8%) with manageable volatility (~10-12% standard deviation), generating attractive risk-adjusted returns.

Tools and Strategies for Assessing Risk-Adjusted Returns

Focusing solely on raw returns can be misleading, as higher returns may come with disproportionate risk. To evaluate investments more comprehensively, investors utilize risk-adjusted performance metrics such as the Sharpe Ratio, Sortino Ratio, and the Treynor Ratio. Sharpe Ratio measures excess return per unit of total risk (standard deviation). A higher Sharpe ratio indicates better compensation for risk taken. Sortino Ratio refines this by considering only downside volatility, placing greater emphasis on harmful fluctuations. Treynor Ratio assesses returns relative to systematic risk (beta), useful in portfolios aligned with market movements.

For instance, over the past 10 years, an ETF tracking the S&P 500 might show a Sharpe ratio of 1.2, whereas a high-yield bond fund with similar returns but higher volatility could have a Sharpe ratio of 0.8. This suggests the S&P 500 fund offers a better risk-adjusted reward despite the higher nominal volatility.

Investors can also rely on Monte Carlo simulations to project a range of potential outcomes using historical data and statistical modeling, helping to visualize the probability distributions of returns and assess risk scenarios under varying assumptions.

Psychological Factors Influencing Risk and Reward Decisions

Beyond quantitative metrics, behavioral finance highlights that investors’ perception of risk and reward is heavily influenced by emotions and cognitive biases. Loss aversion, for example, causes individuals to feel the pain of losses more acutely than the pleasure of gains, often skewing decisions towards excessive caution or irrational panic selling during downturns.

Overconfidence bias leads some investors to underestimate risks and overestimate potential rewards, resulting in overly aggressive portfolios or speculative trades. Herd behavior can trigger bubbles as investors chase unrealistic gains, ignoring mounting risks.

Education and disciplined processes mitigate these pitfalls. Setting predetermined investment rules, maintaining long-term perspectives, and periodic reviews help balance emotional impulses against rational analysis.

Future Perspectives on Risk and Reward in a Changing Investment Landscape

The investment environment continuously evolves with technological advancements, geopolitical shifts, and emerging asset classes influencing risk-reward paradigms. For instance, the growing adoption of artificial intelligence and algorithmic trading impacts market volatility and liquidity, presenting new risk scenarios.

Environmental, Social, and Governance (ESG) investing integrates non-financial risks such as climate change and social responsibility, altering traditional reward expectations by emphasizing sustainable returns. According to a 2023 report by MSCI, ESG-focused portfolios have demonstrated competitive risk-adjusted returns compared to conventional investments, reflecting evolving investor priorities.

Cryptocurrencies and decentralized finance offer high-reward prospects but entail regulatory, security, and valuation risks that challenge conventional frameworks. Investors need to adapt risk assessment methods for these novel assets, combining fundamental analysis with technological scrutiny.

Additionally, advances in risk modeling incorporating big data and machine learning can enhance prediction accuracy and portfolio optimization. These tools enable proactive risk management tailored to individual preferences, potentially improving the balance of risk and reward over time.

In conclusion, understanding risk versus reward is an indispensable part of crafting effective investment strategies. It requires a nuanced approach that combines empirical data, practical tools, psychological insights, and adaptability to future trends. Such comprehension empowers investors to achieve their financial goals while navigating uncertainties inherent in financial markets.