The 50/30/20 Rule Explained: A Simple Way to Budget Smarter

Managing personal finances can often feel daunting, especially when faced with numerous conflicting budgeting methods and financial advice. Yet, mastering a simple, effective budgeting framework is crucial in building long-term financial stability. One of the most popular and straightforward tools to achieve this is the 50/30/20 rule—a budgeting formula designed to balance spending and saving in an accessible way. First introduced by Senator Elizabeth Warren in her book *“All Your Worth: The Ultimate Lifetime Money Plan,”* this rule has since gained widespread recognition for helping millions take control of their money without overcomplicating the process.

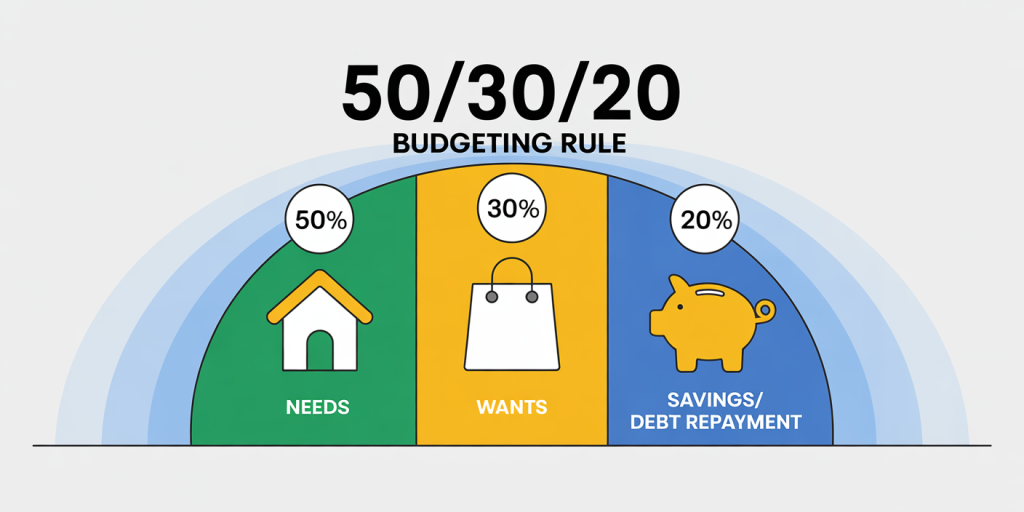

The 50/30/20 rule divides your after-tax income into three major categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This structure encourages mindful spending, prioritizes financial security, and fosters smart saving habits. But how exactly does the rule work in practice, and how can it be adapted to different financial situations? This article dives deeply into the mechanisms behind the 50/30/20 rule, practical applications, and how it compares with other budgeting methods, enabling you to budget smarter.

Anúncios

Understanding the Basics: What Constitutes Needs, Wants, and Savings?

The 50/30/20 rule revolves around categorizing your income into three buckets. “Needs” represent essential expenses required for survival and basic functioning. These include housing costs (rent or mortgage), utilities, groceries, health insurance, transportation (car payments or public transit), and minimum debt payments. For instance, if your after-tax income is $4,000 monthly, no more than $2,000 should be allocated to these needs.

Anúncios

However, needs do not encompass all spending that feels important; discretionary spending like dining out, entertainment, or luxury items belong to “wants.” The “wants” bucket—ideally around 30% of income—allows for lifestyle choices that enrich your life but are not essential for basic survival. For example, this could include movie tickets, hobbies, or travel expenses.

The remaining 20% is dedicated to “savings and debt repayment.” This category includes contributions to emergency funds, retirement accounts, additional loan payments beyond minimums, and other investments that build financial security over time. Prioritizing this portion helps to create a safety net and reduces financial stress in the long run.

Practical Example: Applying the 50/30/20 Rule to a Monthly Budget

To illustrate the 50/30/20 rule in action, consider a working professional with a net monthly income of $5,000. According to the rule, $2,500 would be allocated to needs, $1,500 to wants, and $1,000 toward savings and debt repayment.

| Category | Percentage | Monthly Amount | Typical Expenses Included |

|---|---|---|---|

| Needs | 50% | $2,500 | Rent, utilities, groceries, insurance |

| Wants | 30% | $1,500 | Dining, entertainment, subscriptions |

| Savings/Debt Repay | 20% | $1,000 | Emergency fund, retirement, loan payment |

A real case study comes from Emily, a 29-year-old marketing analyst, who earns $48,000 a year after taxes. Before adopting this rule, Emily struggled with overspending on non-essential items and had virtually no savings. After restructuring her budget according to the 50/30/20 guideline, she reduced impulsive buys and allocated $800 monthly to increasing her emergency fund and paying off credit card debt early. Within a year, Emily observed a 40% increase in her savings balance and a notable decline in financial anxiety, demonstrating the rule’s effectiveness.

Advantages of the 50/30/20 Rule Over Other Budgeting Methods

Compared to detailed zero-based budgeting (which assigns every dollar a purpose before spending) or envelope systems (physically allocating cash for various expenses), the 50/30/20 rule offers simplicity and flexibility. Its straightforward ratio-based approach makes it accessible to individuals who might be overwhelmed by micronized budget tracking.

Moreover, the rule emphasizes balance by not solely focusing on strict frugality but by including spending on wants. This feature encourages adherence, as completely eliminating discretionary spending often leads to budget fatigue and abandonment. According to a 2023 survey by the National Endowment for Financial Education, individuals using flexible budgeting systems, such as the 50/30/20 rule, were 25% more likely to maintain sustainable budgeting habits compared to those following rigid plans.

| Budgeting Method | Complexity | Flexibility | Focus | Ideal For |

|---|---|---|---|---|

| 50/30/20 Rule | Low | High | Balanced allocation | Beginners, busy professionals |

| Zero-Based Budget | High | Low | Every dollar assigned | Detail-oriented individuals |

| Envelope System | Medium | Medium | Cash-based control | Cash users, impulsive spenders |

However, the rule is not without limitations, particularly in high-cost living areas where needs might routinely exceed 50% of income. Tailoring the percentages might be necessary for such contexts to maintain balance.

Adjusting the 50/30/20 Rule for Different Financial Circumstances

While the 50/30/20 rule provides a solid default framework, individual circumstances may require modifications to better fit unique financial goals or obligations. For example, young professionals burdened by student loans might choose to prioritize a larger portion of their income toward debt repayment, reducing the “wants” allocation temporarily.

Consider Michael, a software engineer with a $6,000 monthly net income but living in an expensive city where rent and utilities consume 60% of his earnings—that’s $3,600 per month on needs alone. Applying the 50/30/20 rule rigidly would be impractical. Instead, Michael adjusted his categories to 60/20/20 (needs/wants/savings) while ensuring savings and debt repayments still made up at least 20% of his income, crucial for his long-term goals.

On the other hand, retirees or people with paid-off mortgages might reverse the allocations, spending less on needs and increasing wants or savings. The table below outlines typical adjusted versions for various demographics:

| Demographic | Needs (%) | Wants (%) | Savings/Debt (%) | Notes |

|---|---|---|---|---|

| High living cost areas | 60-65 | 15-20 | 15-20 | Adjusted to account for elevated expenses |

| Young professionals | 40-50 | 20-25 | 25-35 | Prioritize debt repayment and savings |

| Retirees | 30-40 | 40-50 | 10-20 | More flexibility for discretionary spending |

| Families with children | 50-55 | 20-25 | 20-25 | Childcare increases ‘needs’ costs |

Understanding these nuances fosters smarter budgeting decisions tailored to real-life situations rather than strict adherence to a single formula.

How the 50/30/20 Rule Supports Financial Health and Reduces Stress

Adopting the 50/30/20 budget has been linked to improved financial wellbeing and reduced psychological stress associated with money management. A 2022 study published in the *Journal of Financial Planning* found that participants who followed structured budgeting frameworks reported 30% lower levels of financial anxiety compared to those without clear budgeting habits.

Allocating a fixed portion to savings ensures individuals consistently build emergency funds, protecting them from unforeseen expenses without resorting to high-interest debt. Moreover, the “wants” category legitimizes non-essential spending, which prevents burnout by allowing enjoyable experiences without guilt.

For instance, Jessica, a 35-year-old teacher, credits the 50/30/20 rule for helping her pay off her $15,000 student loans in three years while still affording vacations and dining out. She remarks, “Knowing I had a set ‘fun money’ portion made it easier to stick to my budget and avoid feeling deprived.” This psychological balance is crucial in promoting long-term, sustainable financial habits.

Future Perspectives: The 50/30/20 Rule in a Changing Financial Landscape

As financial technology and personal finance education evolve, the foundational principles of the 50/30/20 rule remain relevant but ripe for enhancement. Digital budgeting apps increasingly integrate automatic categorization of expenses by needs, wants, and savings, helping users apply the rule effortlessly through real-time tracking.

Additionally, the growing gig economy and irregular income patterns prompt adaptations for non-traditional earners. For those with fluctuating income, a modified “percentage of average income” approach paired with a buffered savings category ensures they manage cash flow without stress.

Looking ahead, the rule could incorporate emerging financial priorities such as green investments or social impact saving, aligning budgets with ethical values. Financial literacy programs worldwide are also embracing the 50/30/20 framework as an introductory model, ideal for teaching foundational money management.

Moreover, policymakers and employers might integrate the rule into employee wellness programs, combining budgeting education with retirement planning and debt counseling. The simplicity and flexibility of the 50/30/20 rule make it an enduring tool capable of evolving alongside changing economic realities.

—

Mastering the art of budgeting is essential for achieving financial goals and maintaining peace of mind. The 50/30/20 rule offers a clear, manageable pathway to smarter budgeting by balancing essential living costs, discretionary spending, and savings priorities. Its adaptability across different income levels, life stages, and economic contexts underlines its universal appeal. Whether you are just starting your financial journey or looking to simplify your money management, applying the 50/30/20 rule could be the key to taking control of your finances with confidence and clarity.