Digital Wallets & Financial Apps: How to Use Technology to Organize Your Money

In today’s fast-paced digital world, managing personal finances has evolved far beyond traditional methods such as pen and paper budgets or bulky checkbooks. The rise of digital wallets and financial applications has transformed how people organize, spend, save, and invest money. These technologies offer convenience, security, and insights that help users gain better control over their financial lives. With mobile payment systems, automated budgeting tools, and real-time transaction tracking, consumers worldwide increasingly depend on these platforms to simplify complex money management tasks.

According to a recent report by Statista, the global digital wallet market was valued at nearly $1 trillion in 2023 and is projected to reach $7.5 trillion by 2028, growing at a compound annual growth rate (CAGR) of over 40%. This explosive adoption showcases the significant role these tools play in everyday spending and saving habits. This article explores how digital wallets and financial apps work, provides practical ways to utilize them efficiently, compares popular platforms, and discusses future trends shaping their development.

—

Understanding Digital Wallets and Financial Applications

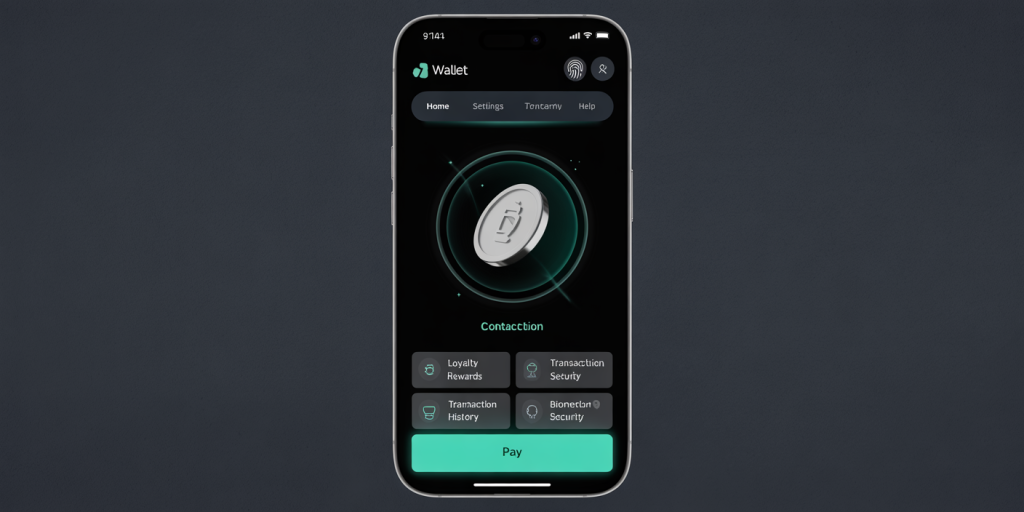

Digital wallets are mobile or web-based tools that store payment information and enable transactions without physical cards. Popular platforms like Apple Pay, Google Wallet, and PayPal allow users to link their bank accounts, credit cards, and even cryptocurrencies to perform seamless payments in stores, online, and peer-to-peer transfers. These wallets eliminate the need to carry cash or worry about losing credit cards, providing encryption and tokenization technologies for secure transactions.

Anúncios

Financial applications, on the other hand, are more diverse in functionality. From personal budgeting apps like Mint and YNAB (You Need A Budget) to investment platforms such as Robinhood or Acorns, these apps cater to various financial management needs. They help users track expenses, plan budgets, monitor credit scores, and make investment decisions based on data-driven insights. Many apps integrate with digital wallets, bank accounts, and credit cards to offer comprehensive views of users’ financial health.

Both categories overlap at times—for example, some digital wallets include budgeting features, and financial management apps integrate payment capabilities. Understanding their core utilities enables consumers to select the right tools for their financial goals.

—

Practical Ways to Use Digital Wallets to Simplify Spending

One of the most immediate benefits of digital wallets is the ease of making purchases. Instead of fumbling through a wallet to find cards or cash, users tap their phones or smartwatches at checkout points. This frictionless experience encourages better spending habits by tracking every transaction automatically. For example, Samsung Pay offers not only NFC-based payments but also MST (Magnetic Secure Transmission) technology, enabling it to work with traditional magnetic stripe terminals, enhancing acceptance.

Real-world examples include the use of digital wallets during major events like Black Friday, when consumers face high volume and time pressure. A survey by Deloitte revealed that 60% of shoppers preferred digital wallets for their speed and contactless nature, reducing checkout lines and improving safety during the COVID-19 pandemic.

Additionally, digital wallets support storing loyalty cards, coupons, and tickets, resulting in consolidated management within one app. Starbucks app users, for example, can reload funds, pay instantly, and collect rewards, which exemplifies how digital wallets bridge payments and incentives seamlessly.

—

Leveraging Financial Apps for Budgeting and Expense Tracking

Budgeting remains a critical component of sound financial management. Financial apps provide automated tools that categorize spending, alert users about bill due dates, and analyze recurring expenses. Mint, a widely-used budgeting tool, securely synchronizes bank and credit card accounts, offering users data visualization through pie charts and cash flow projections.

Consider the case of Sarah, a freelance graphic designer, who used YNAB to gain control over irregular income. By assigning every dollar a “job,” she was able to allocate funds toward essential expenses first and save for emergencies systematically. The app’s real-time updates and goal tracking kept her motivated and financially resilient.

Beyond budgeting, many financial apps incorporate AI-powered insights. For example, Cleo, an AI chatbot, interacts conversationally, providing personalized financial advice and encouraging savings through smart notifications. These features make money management approachable and engaging, especially for younger demographics.

—

Comparing Leading Digital Wallets and Financial Apps

Selecting the best digital wallet or financial app depends on individual preferences, device compatibility, security features, and additional functionalities. The following table summarizes the features of some top contenders:

Anúncios

| App/Wallet | Platform | Key Features | Security Mechanisms | Cost | Best For |

|---|---|---|---|---|---|

| Apple Pay | iOS, macOS | Contactless payments, loyalty cards | Biometric authentication, tokenization | Free | iPhone users |

| Google Wallet | Android, iOS | Peer-to-peer payments, transit passes | Encryption, 2FA | Free | Cross-platform users |

| PayPal | Web, iOS, Android | Online payments, international transfers | Fraud detection, encryption | Transaction fees on transfers | Online shoppers, freelancers |

| Mint | iOS, Android, Web | Budgeting, bill reminders, credit score | Data encryption | Free with ads | Personal budgeting |

| YNAB | iOS, Android, Web | Zero-based budgeting, real-time syncing | Bank-level security | $14.99/month or $99/year | Users needing disciplined budgeting |

| Robinhood | iOS, Android, Web | Commission-free investing, crypto trading | SIPC insurance, encryption | Free, with premium options | Beginner investors |

This comparison highlights the tradeoffs between free and paid services, specialized and all-in-one apps, and various security approaches. For instance, Apple Pay’s seamless integration within the iOS ecosystem suits users already embedded in Apple’s environment, whereas Google Wallet offers cross-platform flexibility.

—

How Digital Tools Enhance Financial Security

Financial security concerns often hinder digital wallet adoption. However, these technologies incorporate multiple layers of protection that often surpass traditional card security. Tokenization replaces sensitive credit card data with unique tokens when making payments. Thus, even if intercepted, tokens are useless for fraudulent use.

Multi-factor authentication (MFA), biometric verification such as fingerprint and facial recognition, and device-specific encryption prevent unauthorized access. Services like PayPal employ advanced fraud prevention algorithms that monitor transactions for anomalies, notifying users promptly about suspicious activities.

For example, a 2022 Consumer Reports study showed that 70% of digital wallet users felt safer digitally than carrying physical credit cards because of these protections. The integration of secure enclaves on hardware chips, such as Apple’s Secure Enclave, improves the protection of stored payment credentials.

Furthermore, users can remotely disable payment capabilities if the device is lost, reducing potential risks. This immediate control is a strong safety net unavailable with cash or physical cards.

—

Future Perspectives: Where Digital Money Management Is Headed

The future of digital wallets and financial apps is closely tied to innovations like blockchain, AI-driven personalized finance, and increased interoperability. Central bank digital currencies (CBDCs) are poised to reshape payments by introducing government-backed digital money directly into digital wallets, enhancing transaction speed and transparency.

Moreover, the rise of decentralized finance (DeFi) platforms offers users options beyond traditional banks to borrow, lend, and earn yield on their assets through financial apps integrated with digital wallets. For example, wallets like MetaMask enable access to DeFi ecosystems, allowing users to participate in global finance without intermediaries.

Artificial intelligence and machine learning will further personalize budgeting, investment advice, and fraud prevention. Imagine apps that auto-adjust savings goals based on lifestyle changes or market conditions, proactively suggesting action before problems arise.

Interoperability standards such as Open Banking will continue to grow, enabling seamless data sharing between financial institutions and apps with user consent. This openness leads to richer insights and more competitive financial product offerings.

In conclusion, embracing digital wallets and financial apps is essential for modern money management. These tools empower users to spend responsibly, budget efficiently, secure transactions, and invest intelligently. As technology advances, the integration of financial services into everyday life will deepen, making money management more intuitive and inclusive for people worldwide.