How to Create a Realistic Monthly Budget (And Stick to It)

In today’s financial landscape, creating a realistic monthly budget is vital for achieving both short-term stability and long-term goals. Budgeting allows individuals to gain control over their finances, prevent unnecessary debt, and increase savings, ultimately leading to greater financial freedom. However, many people struggle with creating budgets that are overly restrictive or unrealistic, which leads to frustration and abandonment of the budgeting process. This article will guide you through crafting a practical monthly budget and offer strategies to adhere to it, ensuring your financial plans are feasible and sustainable.

According to a 2023 survey by the National Endowment for Financial Education, only 42% of Americans maintain a budget, but those who do are 80% more likely to feel confident about their financial future. These numbers highlight the importance of not just budgeting, but of creating budgets that reflect real-life spending habits and income flows. Understanding how to balance your finances without sacrificing your lifestyle is the key to successful budgeting.

Understanding Your Income and Fixed Expenses

The foundation of any effective budget is a clear picture of your income and fixed expenses. Your total monthly income should include all sources such as your salary, freelance earnings, investment dividends, and any additional income streams. It’s crucial to calculate your net income – the amount you take home after taxes and other deductions – instead of simply using your gross salary.

Fixed expenses, such as rent or mortgage payments, utilities, insurance premiums, and debt repayments, generally remain consistent each month. Listing these first provides a baseline from which you can plan the rest of your budget. For example, if your monthly net income is $4,000 and your fixed expenses total $2,200, you are left with $1,800 for variable expenses and savings.

Anúncios

Breaking down fixed expenses helps create transparency and guards against overspending. Using budgeting apps like Mint or You Need A Budget (YNAB) can simplify this process by automatically tracking and categorizing your expenses, ensuring no payments go unnoticed.

Real-World Example

Consider Jane, a graphic designer earning $3,500 per month after taxes. Her fixed costs amount to $1,500, which includes rent, car payments, and insurance. By clearly mapping these out, Jane knows she has $2,000 available for groceries, entertainment, and other variable costs. Without this clarity, Jane might underestimate essential payments, causing shortfalls later in the month.

Anúncios

Allocating Funds for Variable and Discretionary Spending

Variable expenses fluctuate month to month and include groceries, transportation, dining out, and personal care. Discretionary spending is a subset of variable expenses, covering non-essential purchases such as subscriptions, hobbies, and entertainment. Designing your budget to reflect realistic spending in these categories improves adherence.

To estimate these costs accurately, start by tracking your spending over 1-3 months. Categorize expenses and calculate averages. This data-driven approach replaces guesswork with precision. For example, if transportation costs average $150 monthly and dining out totals $300, this reliability prevents the budget from being overly optimistic or imposing unnecessary restrictions.

Comparing your typical variable expenses with your available income allows for smart adjustments, for instance, capping discretionary expenses or reallocating funds.

| Expense Category | Average Monthly Spending | Budgeted Amount |

|---|---|---|

| Groceries | $400 | $450 |

| Transportation | $150 | $150 |

| Dining Out | $300 | $250 |

| Personal Care | $100 | $100 |

| Entertainment | $150 | $150 |

| Total Variable | $1,100 | $1,100 |

This table illustrates an example budget where actual spent amounts align closely with budgeted targets, reflecting realistic financial discipline.

Saving as a Non-Negotiable Part of Budgeting

Building savings into your budget can often be overlooked. Financial experts recommend saving at least 20% of your income, but this can be adjusted depending on individual circumstances. For example, allocating 10-15% towards an emergency fund initially is a good start. Setting up automatic transfers to savings accounts helps make the process effortless and consistent.

Mark Cuban, billionaire entrepreneur, and investor, emphasizes: “The key to wealth is not money; it’s saving money and investing in yourself.” Hence, treating savings as a fixed expense encourages discipline and prioritizes future financial security.

Controlling Impulse Spending and Lifestyle Inflation

Impulse spending often sabotages the best budget plans. It’s estimated that impulse purchases can make up 40% of total monthly spending for some individuals. Preventing these requires intentional actions.

First, set realistic limits on discretionary expenses and use tools such as cash envelopes or budgeting apps to maintain control. For example, allocating a $100 monthly dining-out budget means once it’s used up, any further restaurant bills would require cuts in other areas or deferral to the next month.

Lifestyle inflation is another challenge—when income increases, expenses often rise accordingly. Without mindful budgeting, incrementally higher spending can negate the benefits of a raise or bonus. For example, instead of upgrading to a luxury SUV, committing the additional $200 monthly to savings or paring down debt can accelerate financial goals.

Case in Practice

Mark and Lisa, a married couple, noticed their expenses growing as their combined income rose from $5,000 to $7,000 monthly. By tracking expenses and setting clear budgets, they diverted the additional $2,000 largely to debt repayment and investments instead of lifestyle enhancements. After two years, they had eliminated $15,000 in credit card debt and grown their retirement savings substantially, illustrating disciplined financial behavior.

Using Technology and Tools to Stay on Track

Modern digital tools offer invaluable support for budgeting effectively. Software like YNAB, Mint, or EveryDollar can link to your bank accounts, categorize transactions automatically, and provide visual reports on your spending trends.

For example, Mint generates alerts when you exceed a budgeted category or if a bill is due, helping prevent costly penalties and overspending. YNAB’s method encourages “giving every dollar a job,” meaning each dollar of your income is assigned a specific purpose, from bills to savings, reducing money wastage.

While apps heighten ease and accuracy, they require regular review and manual adjustments reflecting evolving financial situations. Also, maintaining awareness about personal triggers for overspending remains critical.

Comparative Table of Popular Budgeting Tools

| Feature | Mint | YNAB | EveryDollar |

|---|---|---|---|

| Cost | Free | $14.99/month (after trial) | Free with paid version |

| Bank syncing | Yes | Yes | Yes |

| Budget customization | Medium | High | Medium |

| Educational resources | Moderate | Extensive | Moderate |

| Mobile app rating | 4.5/5 (iOS & Android) | 4.8/5 (iOS & Android) | 4.5/5 (iOS & Android) |

This comparison illustrates that while free options like Mint provide necessary functions, paid tools like YNAB can offer better customization and educational support, potentially increasing budgeting success.

Planning for Unexpected Expenses and Adjusting the Budget

Life is unpredictable, and budgets that fail to accommodate emergencies often fail altogether. Experts recommend setting aside an emergency fund equal to 3-6 months of essential living expenses, which can cover unexpected events such as medical bills, car repairs, or sudden unemployment.

For example, if your essential monthly costs (rent, utilities, groceries) total $2,000, your emergency fund target should be $6,000 to $12,000. Starting small by regularly saving $100 or $200 monthly can gradually build this safety net.

Budgets are evolving documents, not static rules. Life changes such as moving, a new job, or family additions require recalibration. Regular monthly reviews allow you to assess where you might overspend or underspend and adjust categories accordingly. For instance, if utility costs decrease during summer months, you can redistribute savings toward holiday spending or investment contributions.

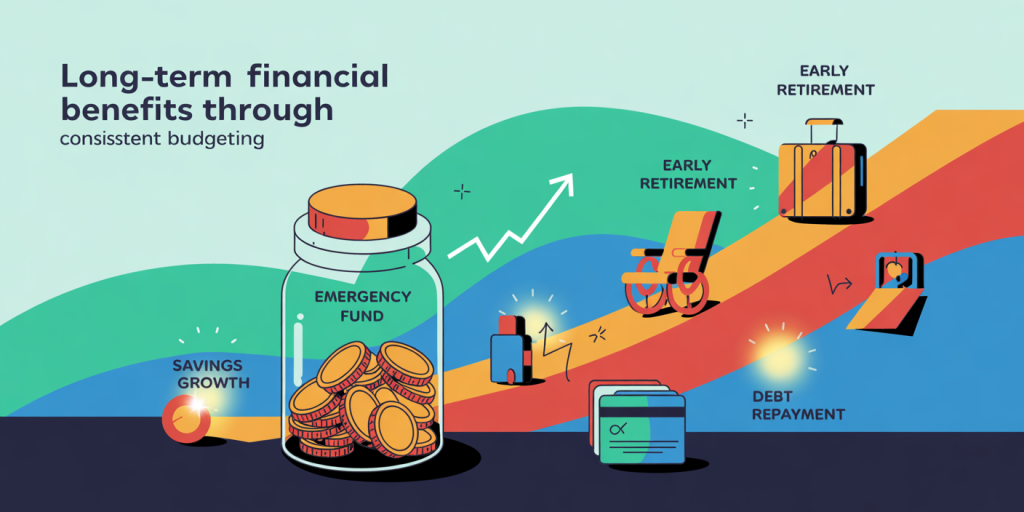

Future Perspectives: The Long-Term Benefits of Consistent Budgeting

The long-term impact of maintaining a realistic budget can be transformative. Systematic budgeting enables consistent saving and investing, which compounding interest can magnify over decades. For example, an individual saving $300 monthly and earning an average annual return of 7% can accumulate over $250,000 after 20 years.

Beyond financial accumulation, budgeting reduces stress and anxiety about money. A study published in the *Journal of Financial Therapy* in 2022 showed that individuals who budget regularly report 30% lower financial stress and significantly better sleep quality.

Moreover, budgeting helps align spending with personal values. For instance, someone passionate about travel can designate a travel fund, ensuring funds are readily available without derailing day-to-day finances. Others might prioritize early retirement, education, or charitable giving, making their budget a roadmap toward those goals.

Emerging Trends in Budgeting

Looking ahead, advancements in artificial intelligence and personal finance software promise even more personalized and adaptive budgeting solutions. AI-driven tools could predict spending habits, identify potential financial risks, and automatically optimize budgets in real time. These technologies will empower users to stay on track even as economic variables fluctuate.

In addition, financial literacy is gaining more emphasis in education and public policy, promising a future where budgeting is a fundamental skill taught from a young age. As such, people may develop healthier financial habits early, reducing debt dependency and increasing wealth accumulation nationwide.