Online Tools to Calculate Investments and Compound Interest

When managing personal finances or planning for future investments, understanding the power of compound interest and how investments grow over time is crucial. Thanks to rapid technological advancements, numerous online tools now empower investors—both novice and experienced—to accurately calculate investment growth, making financial planning more accessible and efficient. These calculators save time, reduce errors in complex computations, and provide visual insights that enable better decision-making.

In this article, we explore a range of online tools designed to calculate investments and compound interest. By tapping into real-world examples, comparative analyses, and current financial statistics, readers will gain a comprehensive understanding of the benefits and limitations of these tools. Whether you are evaluating stock returns, retirement savings, or mutual fund growth, this guide provides practical advice and detailed insights into various calculators and their unique features.

The Importance of Compound Interest in Investment Growth

Compound interest is often called the “eighth wonder of the world” by legendary investor Warren Buffett. It refers to the process where the interest you earn on an investment is reinvested, earning even more interest over time. Unlike simple interest, which is calculated only on the principal amount, compound interest applies to both the principal and accumulated interest, exponentially growing the investment’s value.

Consider a practical example: If you invest $10,000 at an annual interest rate of 6%, compounded annually, after 20 years, your investment grows to approximately $32,071. If instead, the interest were simple, the total would be only $22,000. This difference stems from compound interest’s ability to generate “interest on interest.”

Anúncios

In real life, compound interest plays a critical role in retirement savings. According to a 2023 report by the U.S. Bureau of Economic Analysis, retirees who start saving early, benefiting fully from compound interest over decades, tend to achieve 50% higher retirement corpus compared to those who delay even by five years. Hence, having precise tools to forecast compound growth is invaluable for personalized financial planning.

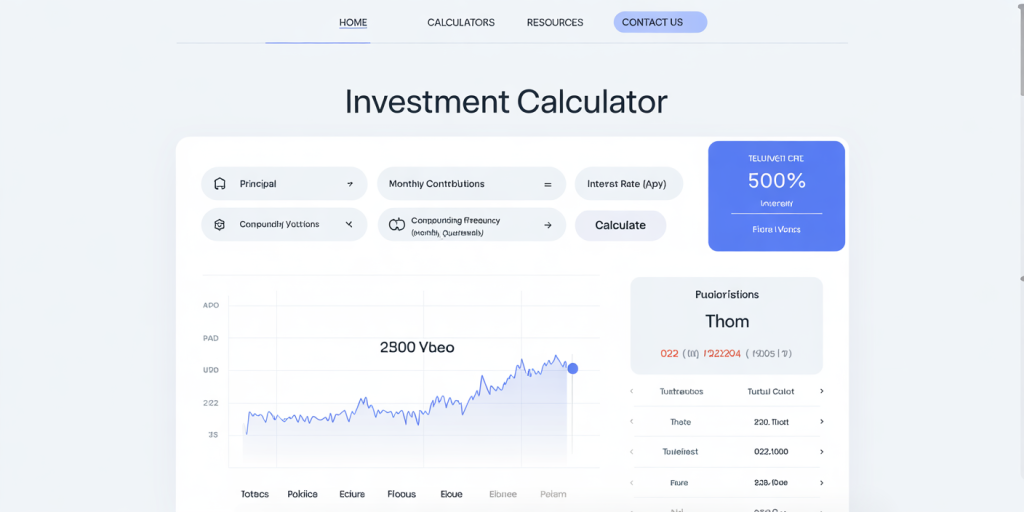

Top Online Investment and Compound Interest Calculators

Today’s market hosts a vast array of online calculators that differ in usability, features, and accuracy. Here, we review some of the most reliable and widely used tools:

Anúncios

| Tool Name | Key Features | Accessibility | Cost |

|---|---|---|---|

| Investor.gov Calculator | Simple user interface, detailed breakdowns, government backed | Web-based, free | Free |

| CalcXML Compound Interest Calculator | Multiple compounding frequency options, adjustable additional contributions | Web-based, mobile-friendly | Free |

| Personal Capital Investment Calculator | Portfolio diversification features, real-time market data integration | Web and app | Free |

| Bankrate Investment Calculator | Includes inflation adjustment, taxable and tax-free options | Web-based | Free |

| NerdWallet Compound Interest Calculator | Step-by-step tutorials, easy to navigate | Web-based | Free |

Many of these calculators provide varying compounding frequencies (daily, monthly, quarterly, yearly) and allow for inputting recurring contributions or withdrawals, making them suitable for complex financial scenarios.

For instance, the Investor.gov Calculator by the U.S. SEC emphasizes transparency and educational value, making it an excellent choice for beginners. Conversely, Personal Capital’s tool integrates with your actual investment accounts to give real-time insights, making it more applicable for active investors managing portfolios.

Practical Examples of Using Online Calculators

Imagine an individual planning for their child’s college fund. They start with an initial investment of $5,000, plan to add $200 monthly, and hope for a return of 7% annually, compounded monthly, over 18 years. Using Bankrate’s Investment Calculator, the projected education fund will likely reach just over $64,000 by the time the child goes to college.

To verify, here is a breakdown:

| Investment Parameters | Value |

|---|---|

| Initial Principal | $5,000 |

| Monthly Contribution | $200 |

| Annual Interest Rate | 7% |

| Compounding Frequency | Monthly |

| Investment Period | 18 years |

| Future Value (estimated) | ~$64,200 |

This figure can help users decide if their current savings rate is adequate or if they should increase monthly contributions.

Another example is retirement planning: Suppose a 30-year-old invests $15,000 with additional $500 monthly contributions earning 8% compounded annually. After 35 years, the investment could grow to approximately $895,000, demonstrating the profound impact of compound interest combined with consistent contributions.

Online calculators save time by automatically factoring variables like inflation, taxes, and fees (when applicable), helping users avoid common pitfalls in manual calculations.

Comparing Features: Which Tool Fits Your Needs?

Choosing the right tool depends on one’s financial goals and familiarity with investment concepts. Below, we contrast four tools based on features relevant for typical investors:

| Feature | Investor.gov | CalcXML | Personal Capital | NerdWallet |

|---|---|---|---|---|

| User-friendliness | High | Moderate | High | High |

| Additional Contributions | Yes | Yes | Yes | Yes |

| Inflation Adjustment | Limited | No | Yes | Yes |

| Tax Considerations | No | No | Yes | No |

| Real-time Market Data | No | No | Yes | No |

| Mobile Compatibility | Yes | Yes | Yes | Yes |

| Detailed Reporting | Moderate | Moderate | High | Moderate |

For users seeking straightforward, government-backed education tools, Investor.gov suffices. However, investors focusing on portfolio optimization with taxes and inflation in mind may prefer Personal Capital.

Leveraging Online Tools for Diverse Investment Strategies

Beyond simple compound interest calculations, many online platforms offer calculators designed for varied investment strategies: Lump-Sum vs. Recurring Contributions: Tools help analyze if investing a one-time sum or making smaller periodic investments yields better returns. Tax-Advantaged Accounts: Some calculators factor in tax implications of IRAs, 401(k)s, or Roth IRAs, offering realistic future value estimations. Risk-adjusted Returns: Advanced tools assess investment volatility and adjust expected returns based on risk tolerance.

For example, using CalcXML’s calculator, an investor name Sarah compares two scenarios: investing $50,000 today as a lump sum versus investing $1,000 monthly over five years at 6% per year compounded monthly. Sarah discovers that while lump-sum investing generally yields higher returns due to earlier capital deployment, dollar-cost averaging through monthly investments reduces risk exposure in volatile markets.

As more investors explore ETFs, bonds, and diversified portfolios, calculators that incorporate asset allocation and historical performance data become indispensable. The financial advisory firm Morningstar offers such tools integrated into their investment research platform, enabling users to simulate portfolio outcomes based on user-defined asset mixes.

Accuracy and Limitations to Consider

While online calculators provide valuable insights, users must recognize their inherent limitations: Assumptions About Rates: Most calculators require fixed or average interest rates, which may not reflect market volatility or unexpected changes. Ignoring Fees and Taxes: Unless specifically included, many tools do not account for management fees, brokerage commissions, or tax burdens, which erode returns. Scenario Variability: Life events, such as job loss or emergency expenses, are not factored in but can impact real investment growth.

According to a 2022 Fidelity Investments study, portfolios that factor in fees reduce expected accumulation by up to 15% over 20 years—highlighting the importance of selecting calculators that include these costs.

Therefore, users should treat calculator results as estimates rather than precise forecasts. Combining outputs from multiple calculators and consulting financial advisors ensures robust planning.

Future Perspectives: The Evolution of Investment Calculators

The financial technology (fintech) landscape continues to evolve, promising increasingly sophisticated tools for managing investments. Artificial Intelligence (AI) and machine learning are being infused to personalize forecasts based on user behavior, market conditions, and economic indicators.

Future online calculators are expected to: Integrate with real-time economic data, providing dynamic updates to projections. Offer tailored recommendations by analyzing individual risk tolerance and financial goals. Include environmental, social, and governance (ESG) factors relevant to socially conscious investors. Utilize blockchain technology to offer transparent, tamper-proof investment tracking tools.

A 2024 Deloitte report projects that AI-driven financial tools will enhance investment accuracy by 25% and reduce user errors by over 30% by 2026. This advancement will make compound interest and investment calculations more reflective of real-world dynamics.

Moreover, virtual and augmented reality technologies could transform how investors visualize portfolio growth, providing immersive educational experiences that empower better financial literacy.

As mobile penetration deepens globally, these calculators will become more accessible, driving higher engagement in personal finance management, particularly among millennials and Gen Z users.

—

In summary, online tools for calculating investments and compound interest are indispensable in the modern investor’s toolkit. Their ability to provide swift, accurate, and customizable analyses enables individuals to make informed decisions, plan effectively, and optimize financial outcomes. Choosing the right tool depends on user sophistication, investment complexity, and desired features such as inflation, tax, and fee considerations.

Staying informed about emerging fintech advancements will allow investors to harness even greater forecasting power, ensuring adaptable, resilient portfolios capable of achieving long-term financial goals. Thus, mastering the use of these calculators today lays the groundwork for smarter, data-driven investing tomorrow.